This article describes how to configure the Principal Deduction Feedback Split by Payroll Site moov for UKG integration. This moov is intended for Principal plans that have more than one Payroll Site. If your client's plan only has one Payroll Site, use the Principal Deduction Feedback to UKG moov instead.

Configuring the UKG API with a Service Account

Before you can configure your client for the Principal Deduction Feedback to UKG moov, you will need to create a UKG Premier Integration. Please review the Configuring the UKG API with a Service account article.

Create a UKG Scheduled Deduction Report

detamoov uses a Scheduled Deductions saved report that is called through the UKG API. Each company will need to have this report created before the 360 integration can be configured. See the Create the Scheduled Deduction Report for 360 Retirement Integrations article for steps on how to create this report.

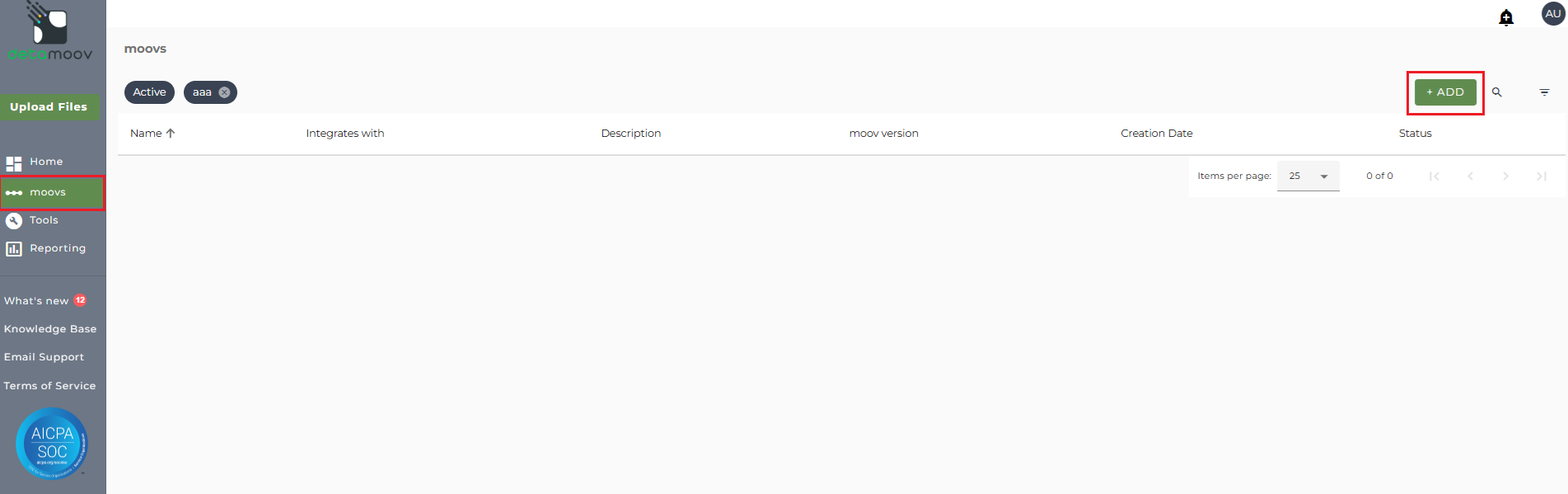

To adopt the Principal Deduction Feedback Split by Payroll Site moov, click on the moovs option on the left and click the ADD button in the upper right.

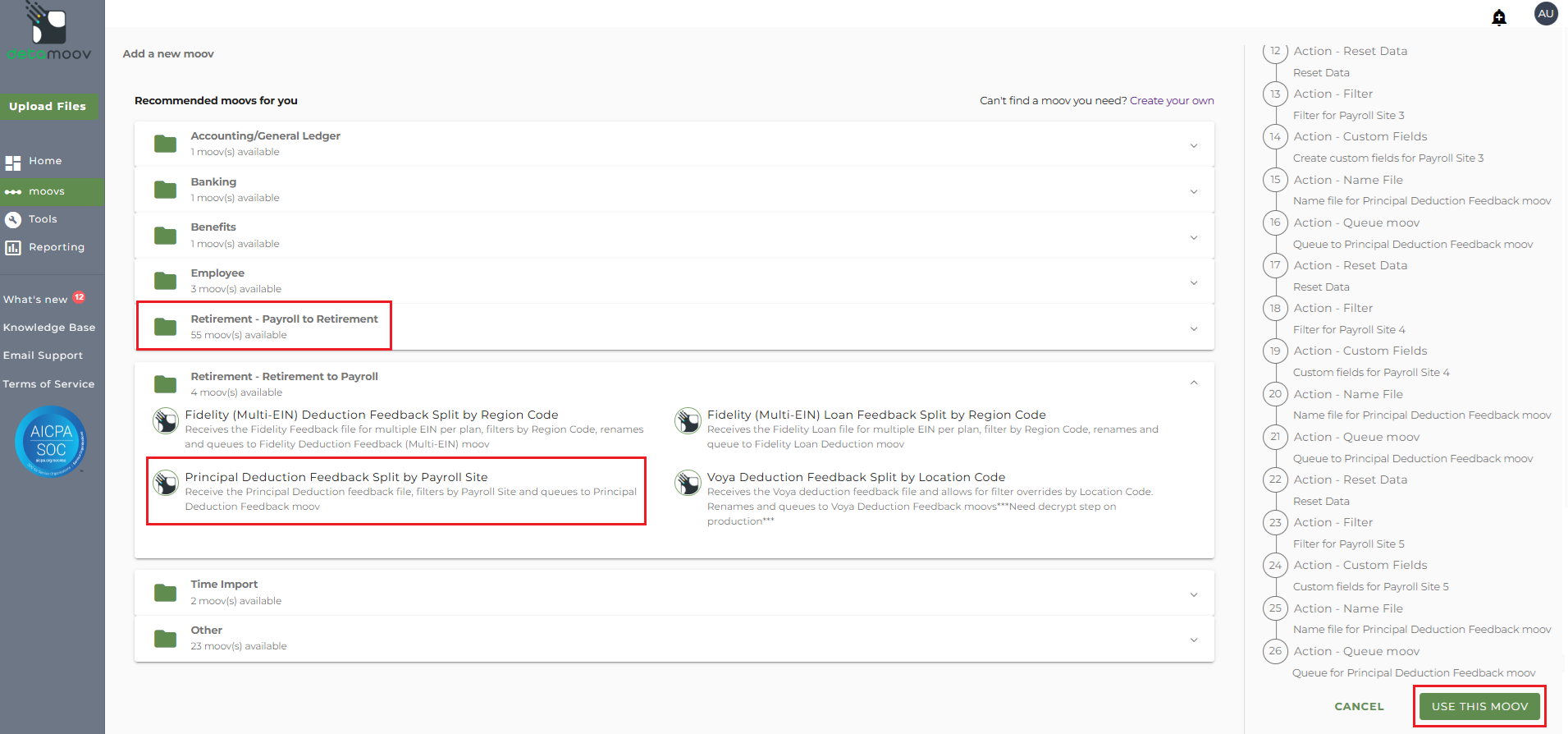

Then expand the 'Retirement - Retirement to Payroll' section, click on the 'Principal Deduction Feedback Split by Payroll Site' moov and click USE THIS MOOV by scrolling down to the bottom of the right sidenav.

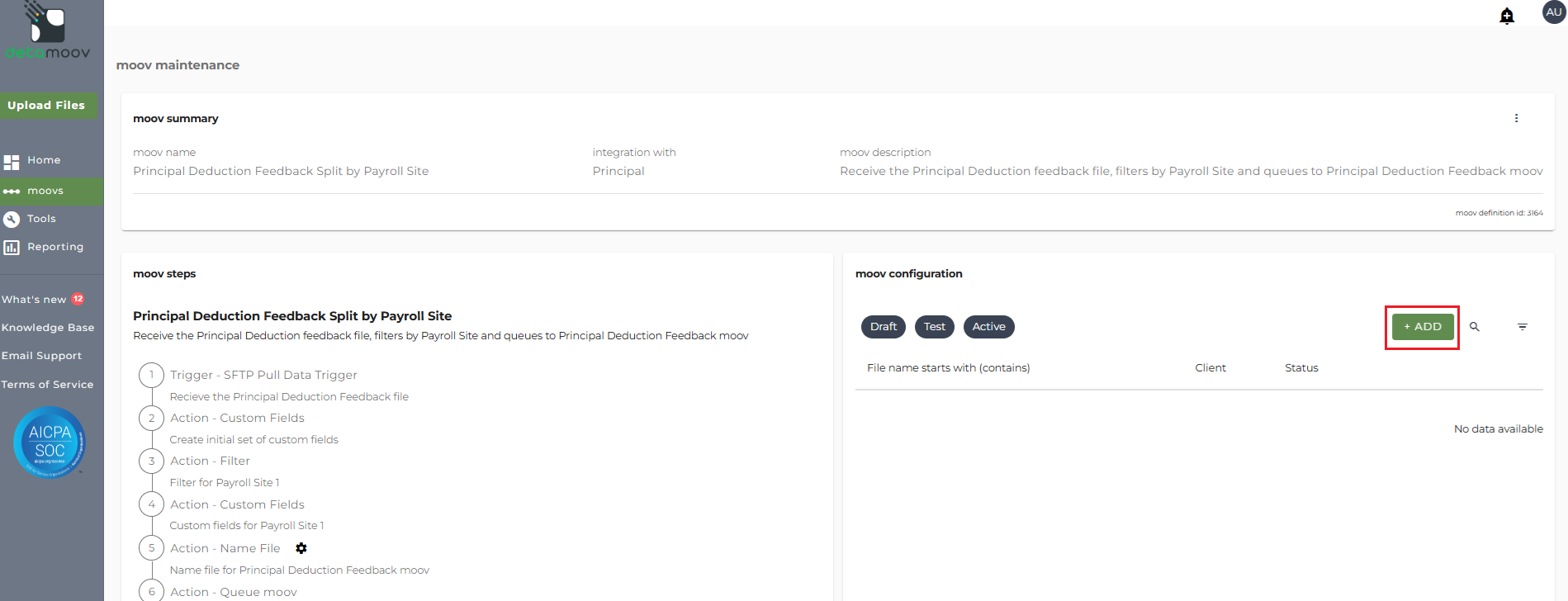

In the moov configuration section, click the Add button to add a new client to the moov.

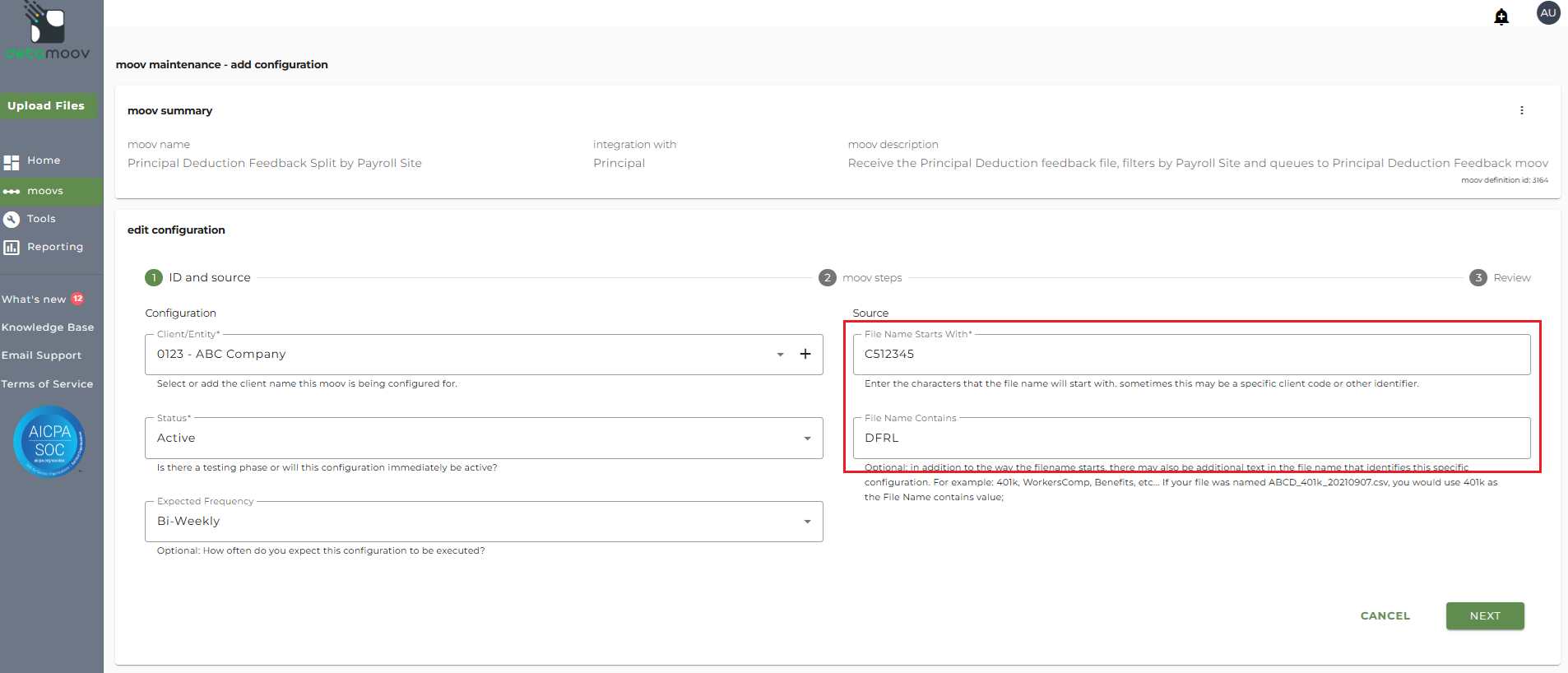

Client/Entity - either select an existing client or click the + sign to create a new client.

Status - Set to Active

Expected Frequency - the client's payroll frequency

File Name Starts With - C[Your client's 6-digit Principal Contract Number]

File Name Contains - DFRL

Note: make sure that the File Name Starts with field matches as this can cause issues pulling the Principal deduction feedback file and updating the payroll platform.

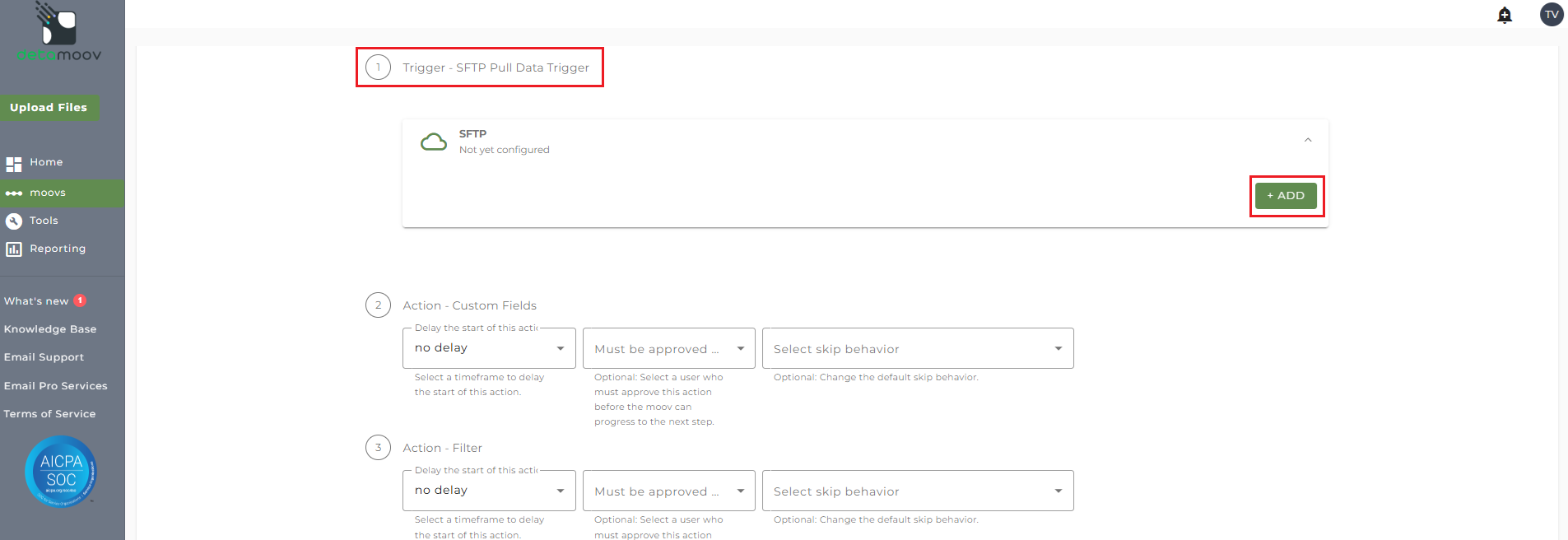

To automate the 360 integration, configure the SFTP schedule. Click the SFTP banner under the Trigger - SFTP Pull Data Trigger step and click Add.

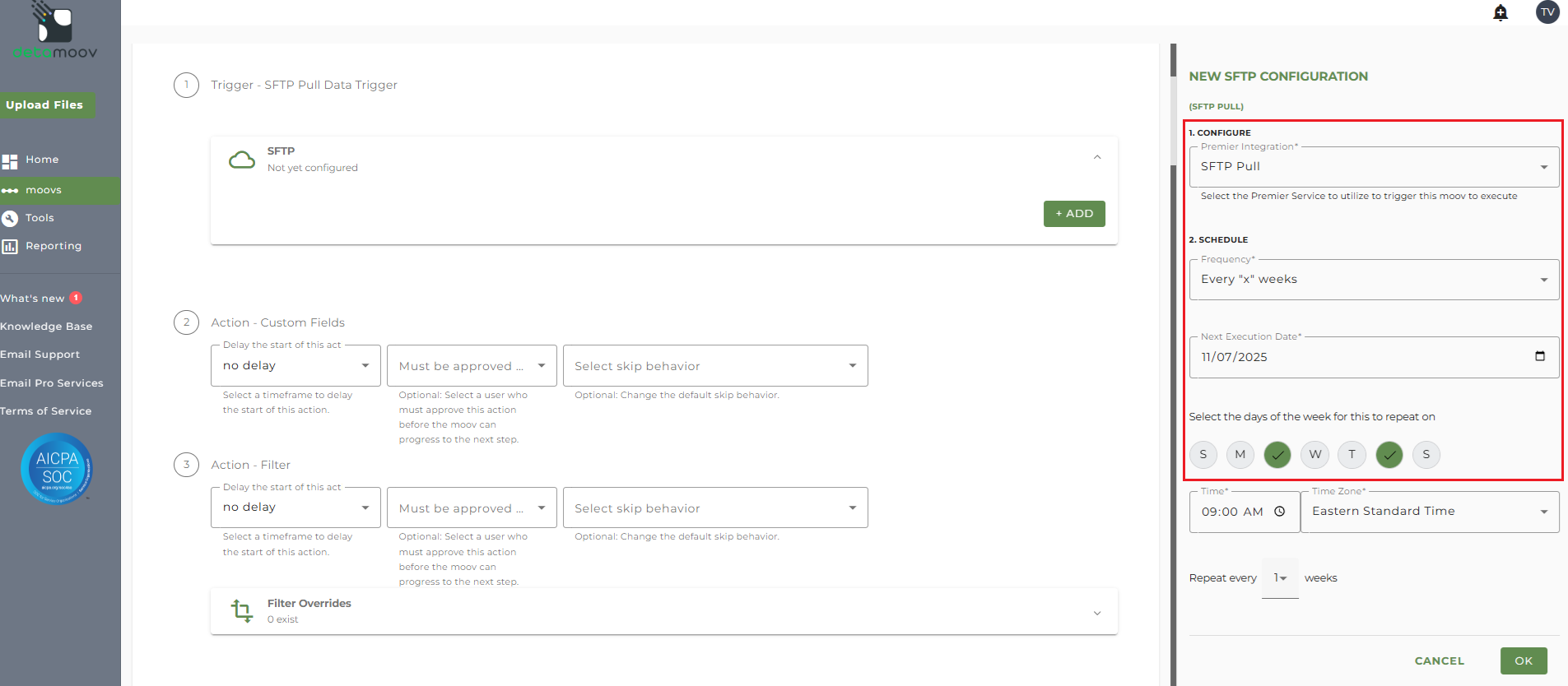

On the New SFTP Configuration section on the right, select the SFTP Pull option from the Premier Integration menu. Then select either "Every X weeks" or "On certain days of the month", depending on how often you would like detamoov to check for new deduction files. We recommend that you check for feedback files at least twice a week. In the example below, we have set up a schedule to check for files twice a week on Tuesdays and Fridays.

Overrides for Filter Step for each Payroll Site

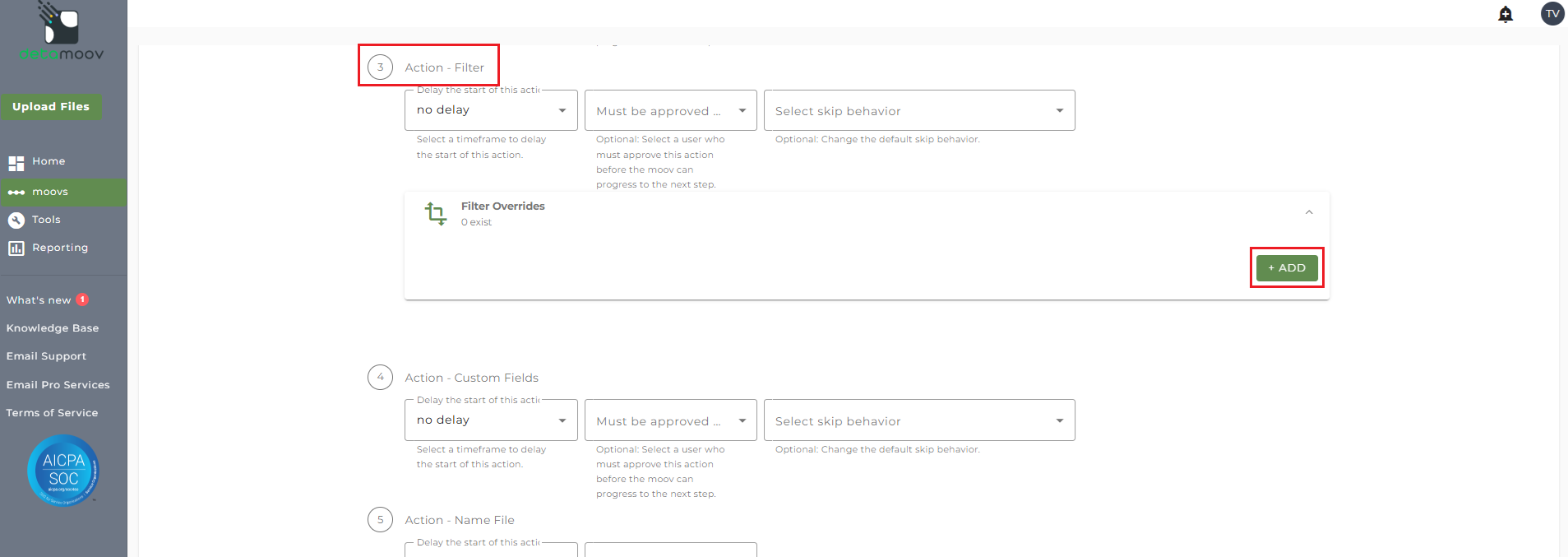

To properly split the Principal Deduction Feedback file by Payroll Site, you will need to provide filter overrides for each location. For example, if our client's Principal plan has three Payroll Sites that we expect in the feedback file, then we need to set filter overrides for the first three filter steps. If there are four Payroll Sites, then four filter overrides are needed, and so on.

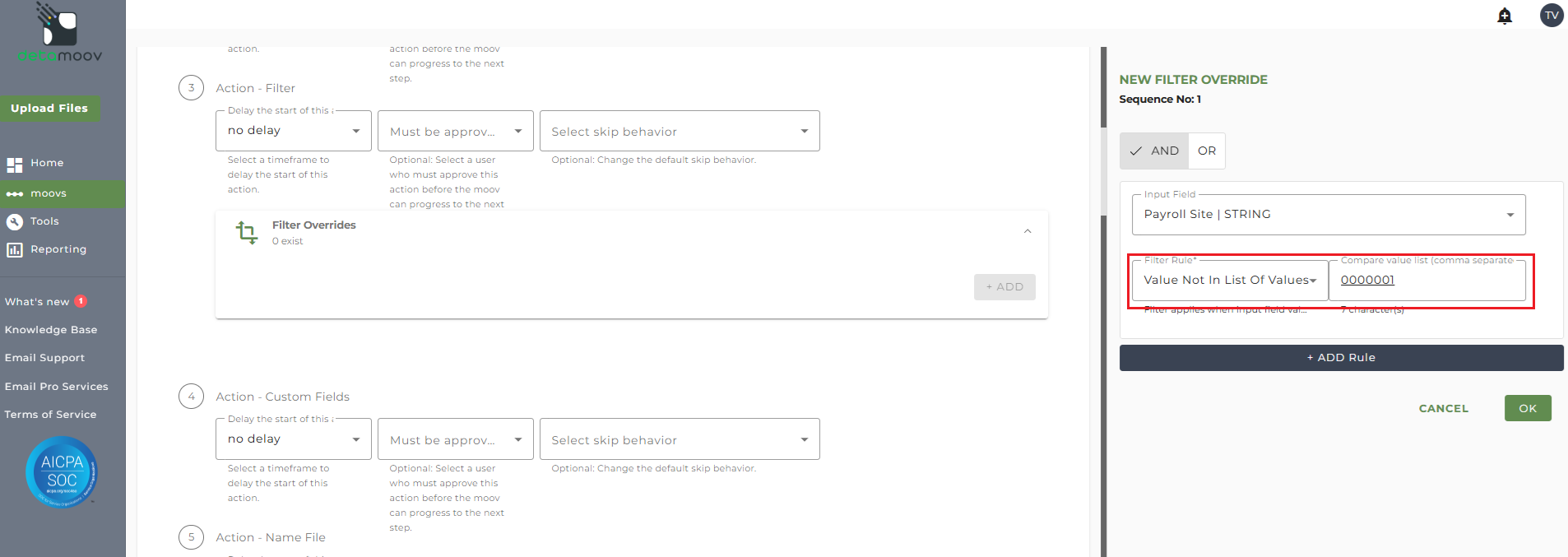

To set a filter override, click on the Filter Overrides panel, click the ADD button.

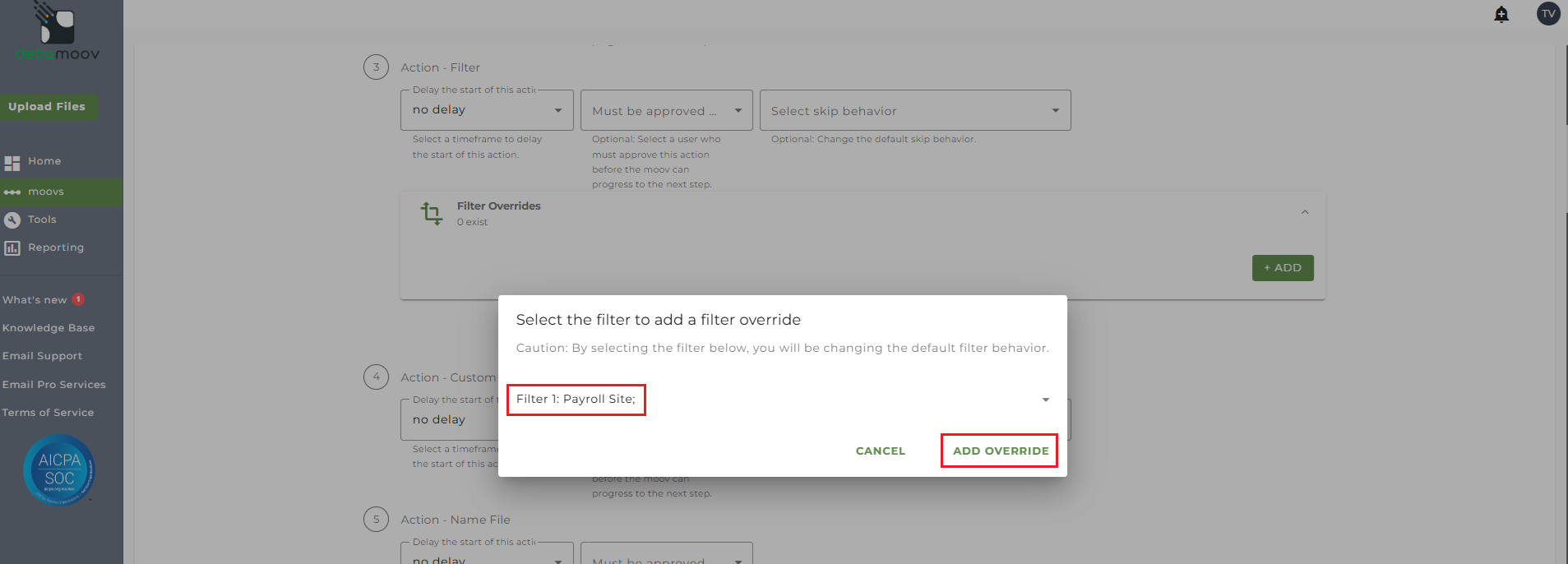

Then select Filter 1: Payroll Site and click ADD OVERRIDE.

The default filter is set to filter out any record where the value is not 9999. You will need to replace the value 9999 with the Payroll Site you expect and click OK.

If you do not know the Payroll Site values for your client's plan, please contact Principal.

The above filter override will need to be repeated for each Payroll Site you expect in the feedback file. Any other Filter steps beyond the number of Payroll Sites you expect should not be changed.

Here is a table showing the step(s) that need a filter override based on the number of Payroll Sites expected in the feedback file:

| Number of Payroll Sites | Filter Steps to Override |

|---|---|

| 2 | Step 3, 8 |

| 3 | Step 3, 8, 13 |

| 4 | Step 3, 8, 13, 18 |

| 5 | Step 3, 8, 13, 18, 23 |

| 6 | Sep 3, 8, 13, 18, 23, 28 |

Once you have provided a filter override for each Payroll Site, scroll to the bottom of the page and Click Next. Then click Save on the summary page.

Configuring a client for the Principal Deduction Feedback to UKG moov

Each client Payroll Site will need to be separately configured for the Principal Deduction Feedback to UKG moov. To configure your client please add the Principal Deduction Feedback to UKG moov to your account by following these steps.

Once the Principal Deduction Feedback to UKG moov has been added to your account, access the moovs section on the left side menu and click on the Principal Deduction Feedback to UKG moov.

The Principal Deduction Feedback to UKG moov provides a notification once the moov is complete with a summary of the deduction changes that were made in UKG. The notification can be sent to any email address you wish and can also be configured to send to multiple email addresses.

To edit the send file step, click on the cog icon under the Action - Send File step on the left. Then toggle the "Use default parameters" off and enter in the email addresses you would like to receive the notification. If you would like to enter multiple email addresses, separate them with a comma. A Reply to email is also required in the event that a recipient of the notification replies to the email.

Note: these settings apply to any client configuration you set up for this specific moov. You also have the ability to configure the send file step for each client configuration if you wish to add or remove email addresses per client.

To save your parameters click on the Save Changes button.

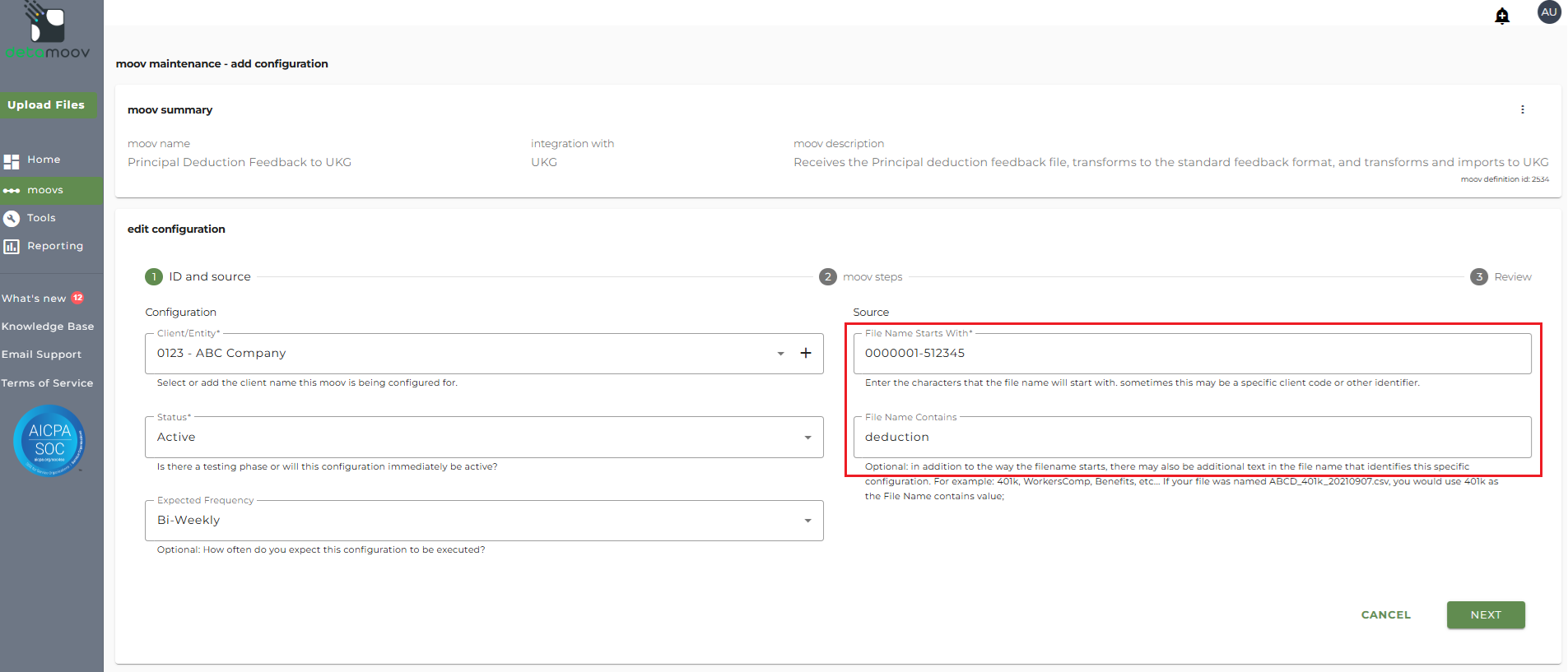

In the moov configuration section, click the Add button to add a new client to the moov.

Client/Entity - either select an existing client or click the + sign to create a new client.

Status - Set to Active

Expected Frequency - the client's payroll frequency

File Name Starts With - [Payroll Site]-[Contract Number]

File Name Contains - deduction

When adding a new client configuration, it is important to understand the naming convention used in the Principal Deduction Feedback Split by Payroll Site moov. Each Payroll Site file is renamed using the naming convention:

[Payroll Site]-[Contract Number]-deduction.csv

To ensure that the each Payroll Site file is associated with the correct client configuration, the File Name Starts with and File Name Contains fields must be correct. For example, if we provided a Filter Override for Payroll Site 0000001 and Contract Number 512345, our ID and Source would look like this:

Note: make sure that the File Name Starts With and File Name Contains fields are correct as this can cause issues updating UKG.

Important: The SFTP Pull Data Trigger section should NOT be configured when you are using the Principal Deduction Feedback Split by Payroll Site moov.

UKG Deduction Code Transformation Override

If your UKG deduction codes for your client are different than the default values in the table below, you will need to create a transformation override to update the mappings.

The table below shows the Principal deduction code for the employee, the code detamoov maps the Principal code to, and the default UKG deduction code.

Deduction Code Table

| Principal Deduction Code | detamoov Code | UKG Deduction Code (default) |

| 0001 | 401k | 401k |

| 0017 | 401k Catch Up | |

| 0021 | 401k Roth | Roth401k |

| 0041 | 401k Roth Catch Up |

Below is an example of a UKG Deduction. detamoov uses the value in the Code field as shown below:

Override Existing Deduction Code Mapping

Example 1: detamoov receives the Principal deduction code 0001 and converts it to 401k. A transformation is then performed to convert 401k to the UKG code. By default, this value would be 401k. If your client's deduction code is different in UKG, say your UKG deduction code is PreTax instead of 401k, then you will need to provide a transformation override for the Deduction Code field.

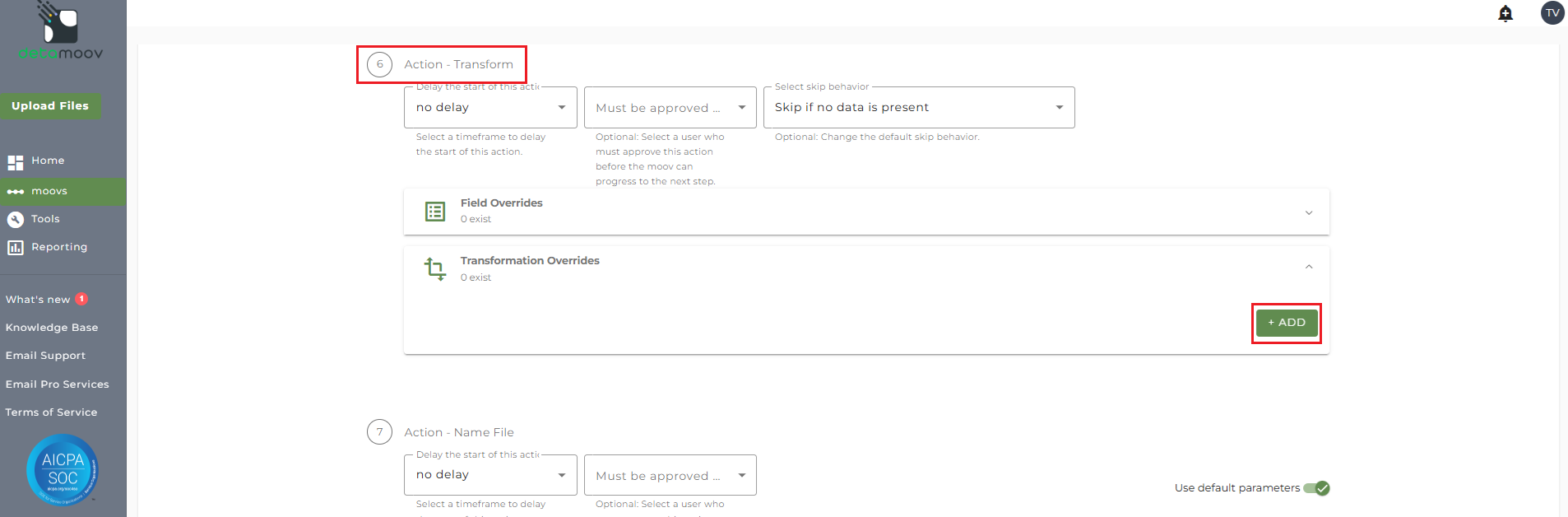

Note: The Principal Deduction Feedback to UKG moov contains 3 separate Transform steps. The following information relates to step 6 Action - Transform only.

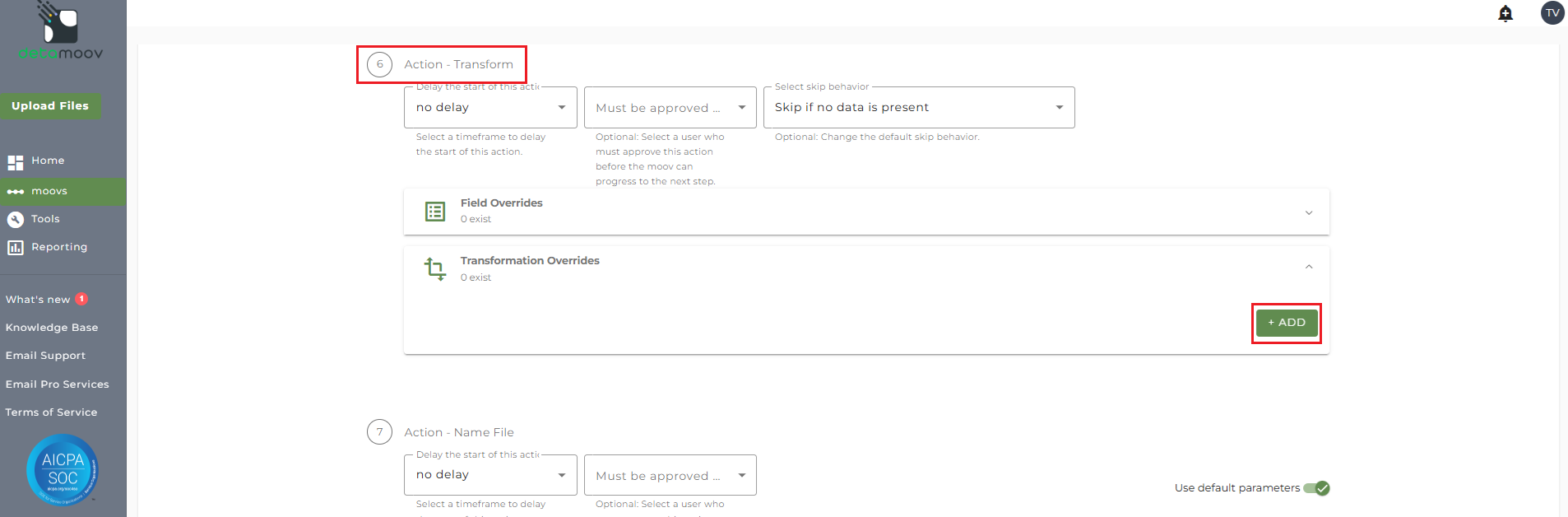

To provide a transformation override, locate step 6 - Action Transform, expand the Transformation Overrides panel and click ADD.

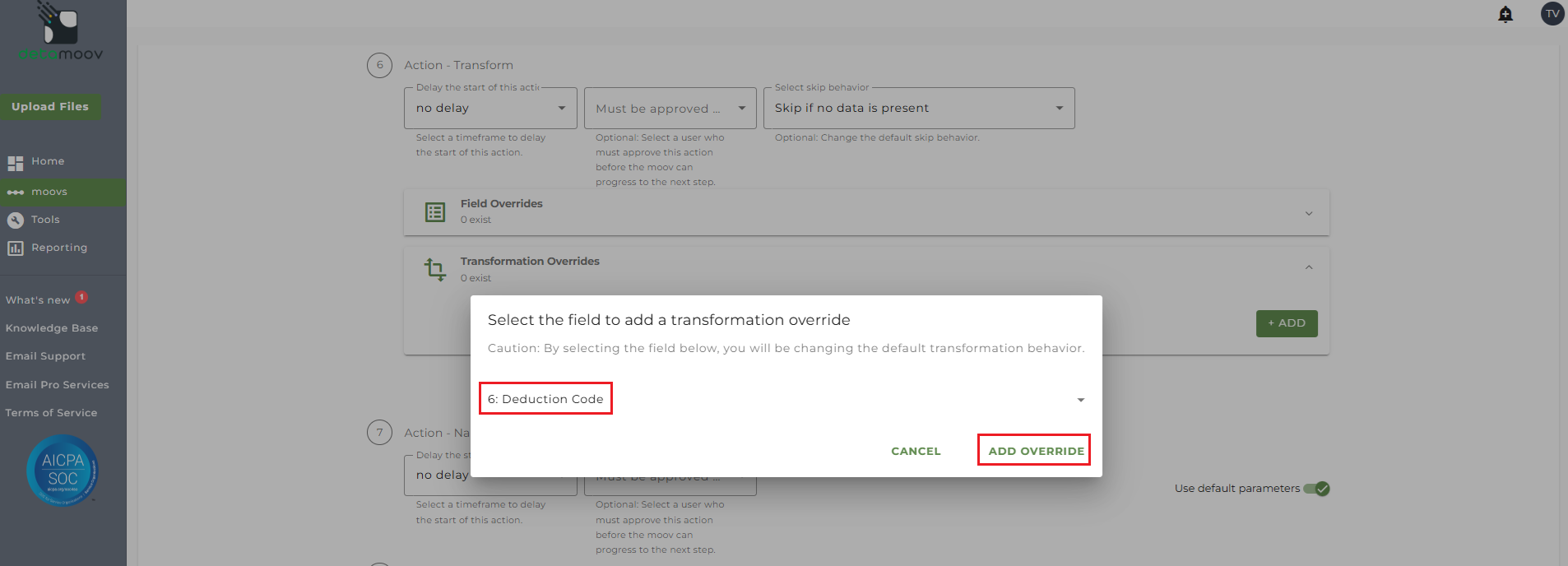

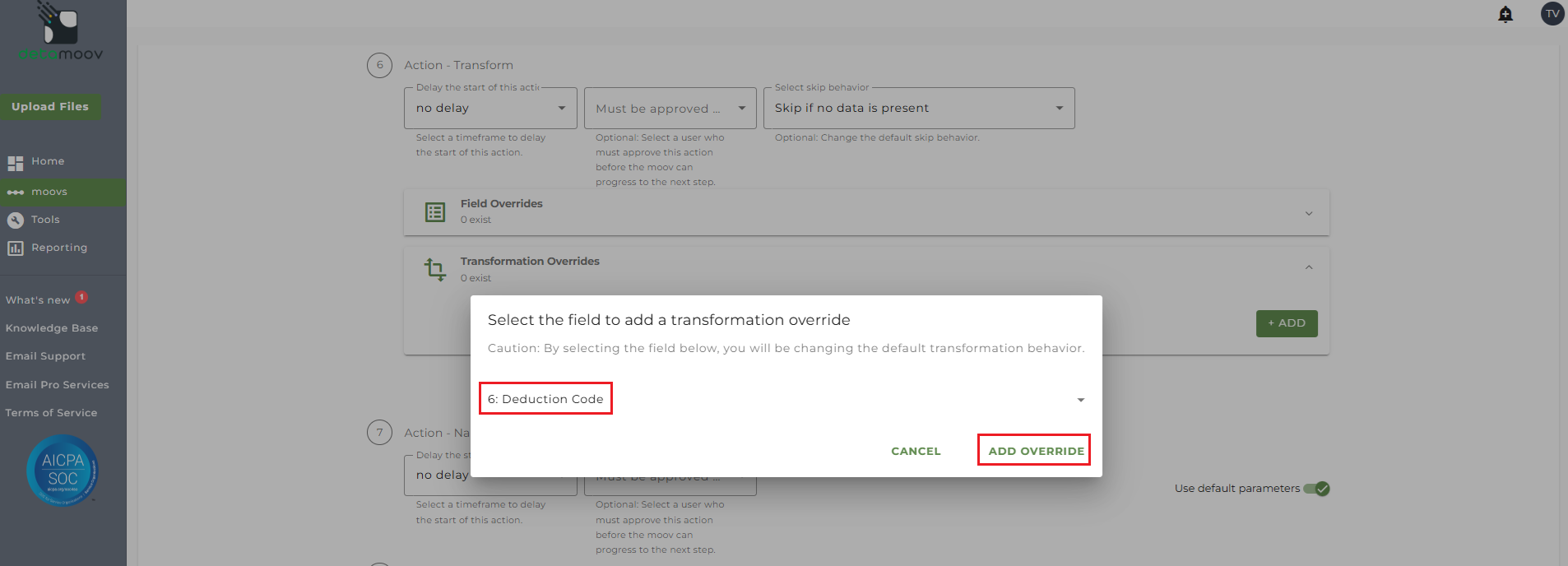

Then select field 6: Deduction Code and click ADD OVERRIDE.

On the side panel that appears, in the Replacement Groups field, replace the right side of 401k|401k with your client's deduction code.

In our example, we will replace 401k with PreTax and then click OK.

Override to Add Contribution Code Mapping

Example 2: detamoov receives the Principal deduction code 0017 and converts it to 401k Catch Up. Since we don't set a default for this code when converting to UKG, you will need to provide a transformation override to include the replacement group 401k Catch Up|[your UKG Code].

To provide a transformation override, locate step 6 - Action Transform, expand the Transformation Overrides panel and click ADD.

Then select field 6: Deduction Code and click ADD OVERRIDE.

On the side panel that appears, in the Replacement Groups field, add a new group: 401k Catch Up|[your UKG Code]. If your UKG deduction code, for example, is CatchUp, then we would include the following and click OK.

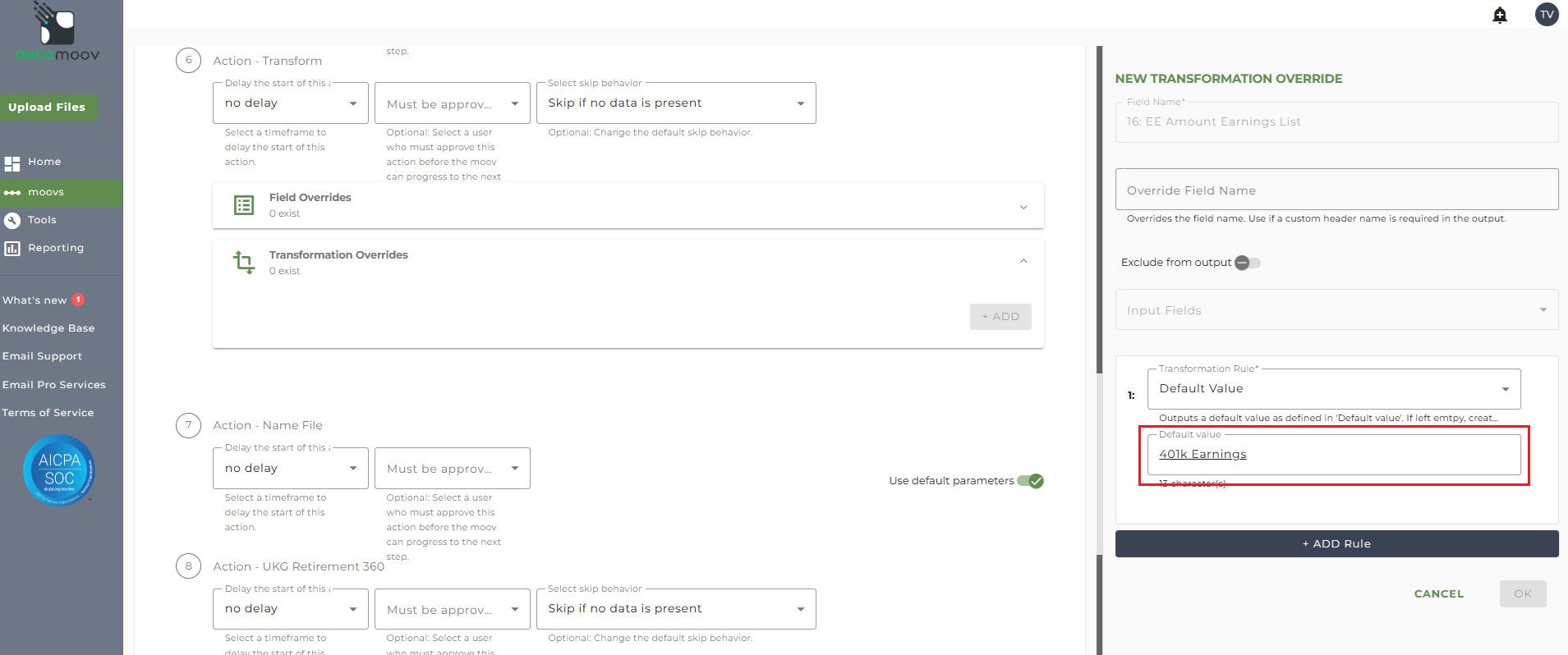

UKG Earnings List Transformation Override

detamoov has a default value of "401k Earnings" set as the Earning Lists sent to UKG. If your client's plan has a different value, you will need to create an override to set this value.

Note: The Principal Deduction Feedback to UKG moov contains 3 separate Transform steps. The following information relates to step 6 Action - Transform only.

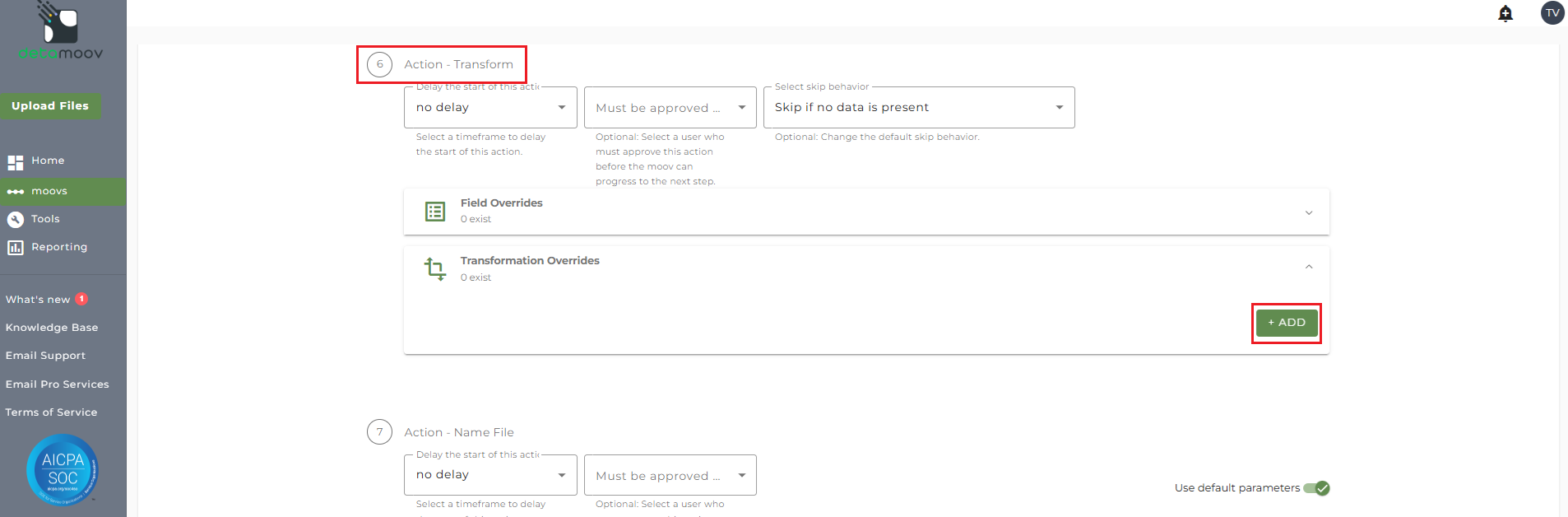

To provide a transformation override, locate step 6 - Action Transform, expand the Transformation Overrides panel and click ADD.

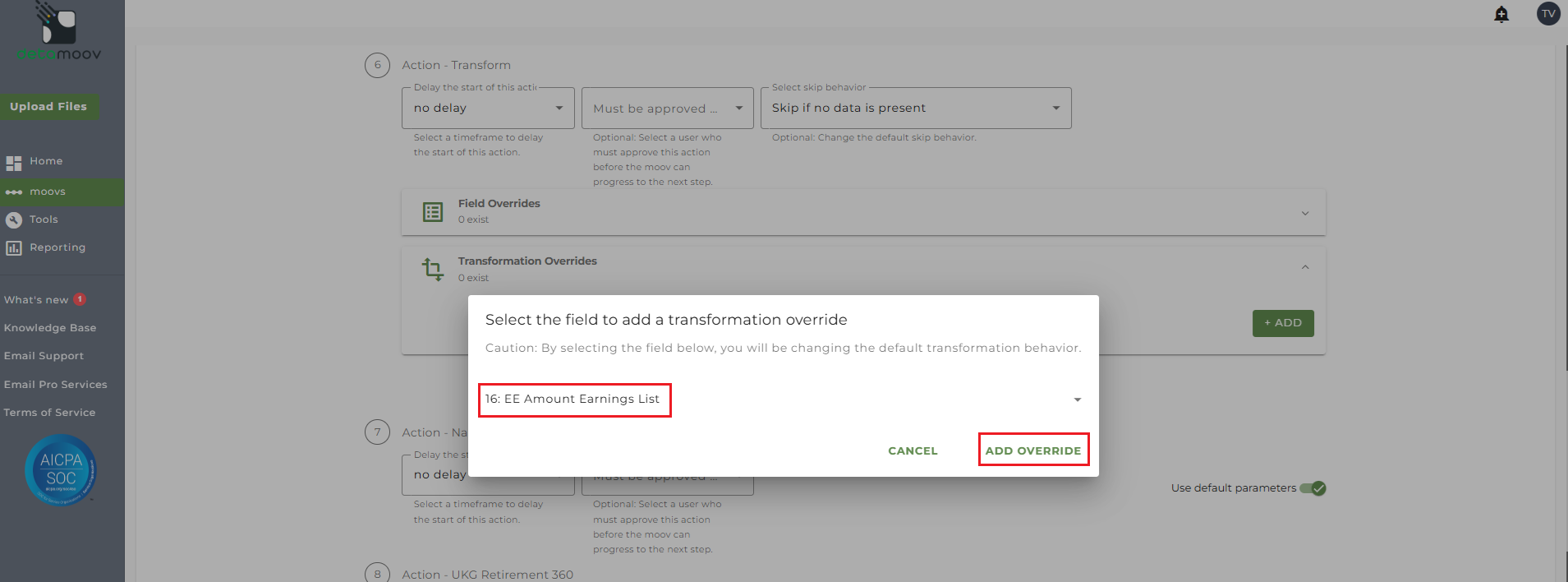

Then select field 16: EE Amount Earnings List and click ADD OVERRIDE.

On the side panel that appears, replace "401k Earnings" with your Earnings List value and click OK.

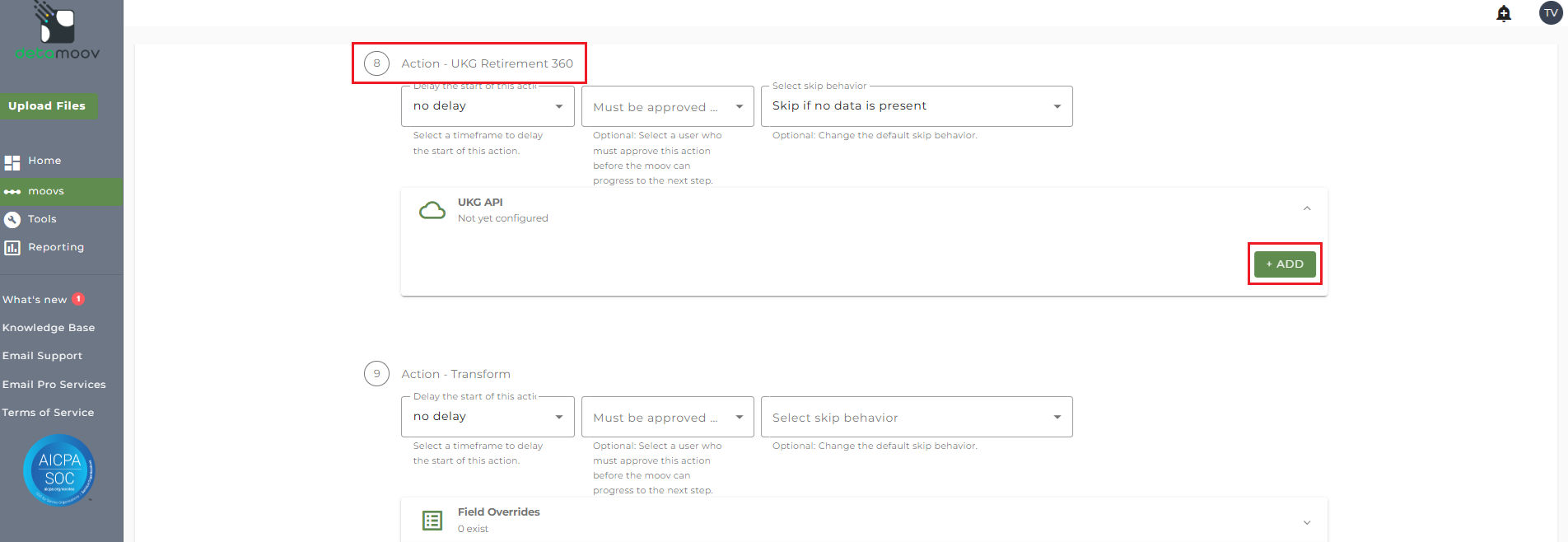

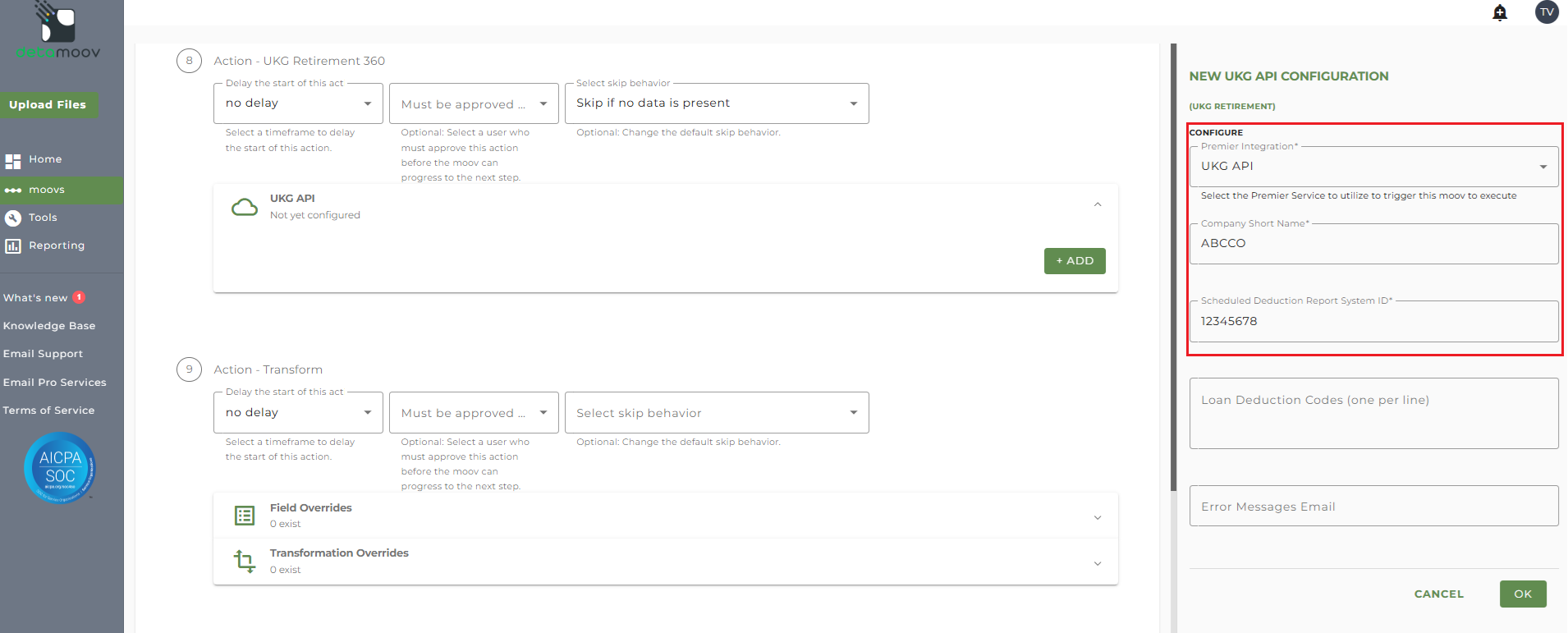

Configure the UKG Retirement 360 Step

To configure the UKG Retirement 360 step for you client, locate the Action - UKG Retirement 360 step, expand the UKG API panel and click ADD.

On the side panel that appears, select your UKG API Premier Integration and enter in the following parameters:

- Company Short Name - the company short name in UKG associated with the Payroll Site for this configuration

- The Scheduled Deduction Report System ID - If you have not created this report, refer to the Create the Scheduled Deduction Report for 360 Retirement Integrations article

- Loan Deduction Codes - This field can be left blank as Principal Loans are sent in a separate feedback file

You can also enter in one or more email addresses in the Error Messages Email. If left blank, all detamoov users on your account will receive emails if the UKG API import fails.

Click OK to complete the UKG Import configuration.

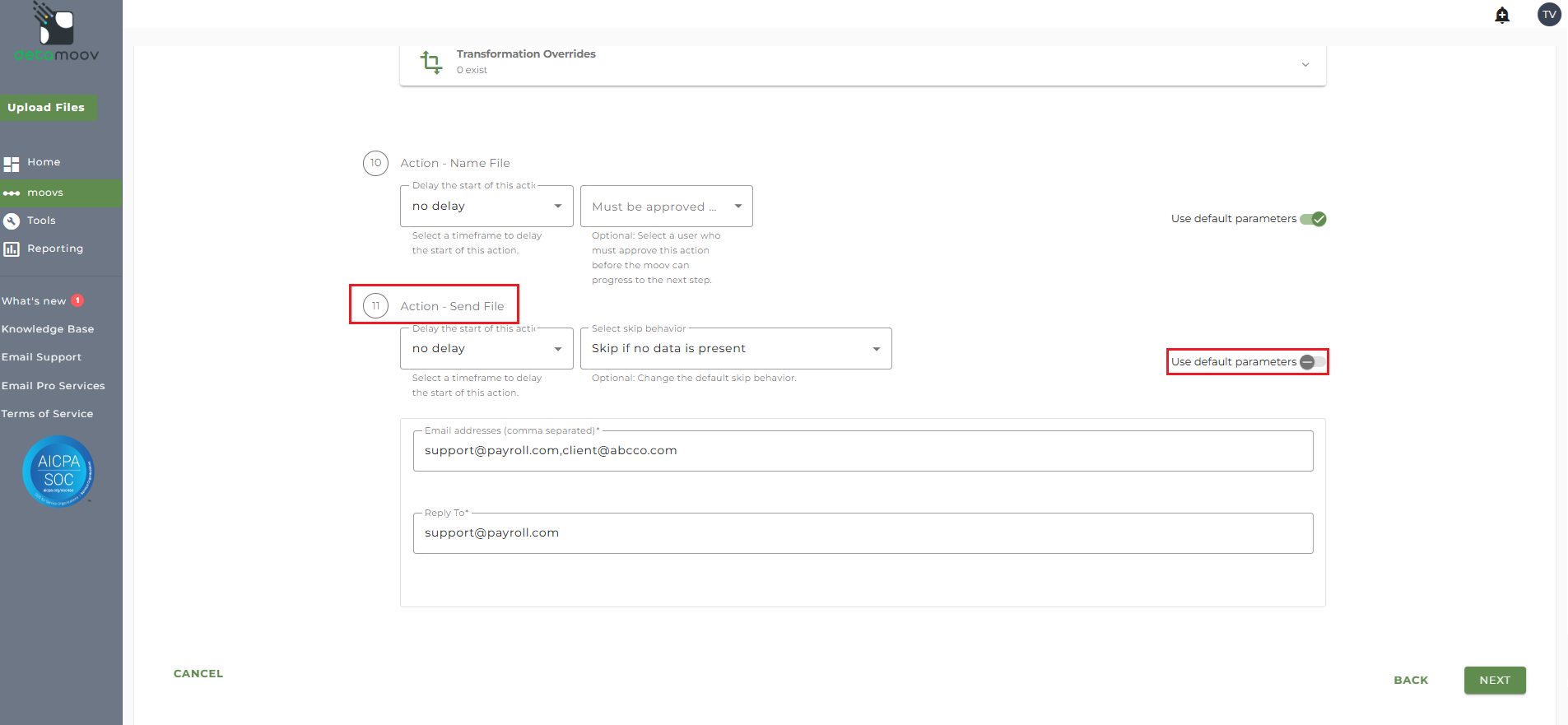

At the beginning of this article you configured the send file step for the moov to send a notification once the moov had completed. You also have the ability to configure the send file step for each client configuration if you wish to add or remove email addresses per client.

To override the send file step, locate the Action - Send File step and toggle the "Use default parameters" off and enter/remove email addresses from Email Address and Reply To fields. If you would like to enter multiple email addresses, separate them with a comma.

To complete the configuration for your client, click the Next button at the bottom of the page and then the Save button on the moov summary page.