This article describes how to configure a client for the Standard Deduction Contribution to Fidelity HSA Contributions moov definition. Each client configuration will vary based on their plan specification and will need to be configured accordingly.

If you have not already done so, please add the Standard Deduction Contribution to Fidelity HSA Contributions moov to your account by following these steps.

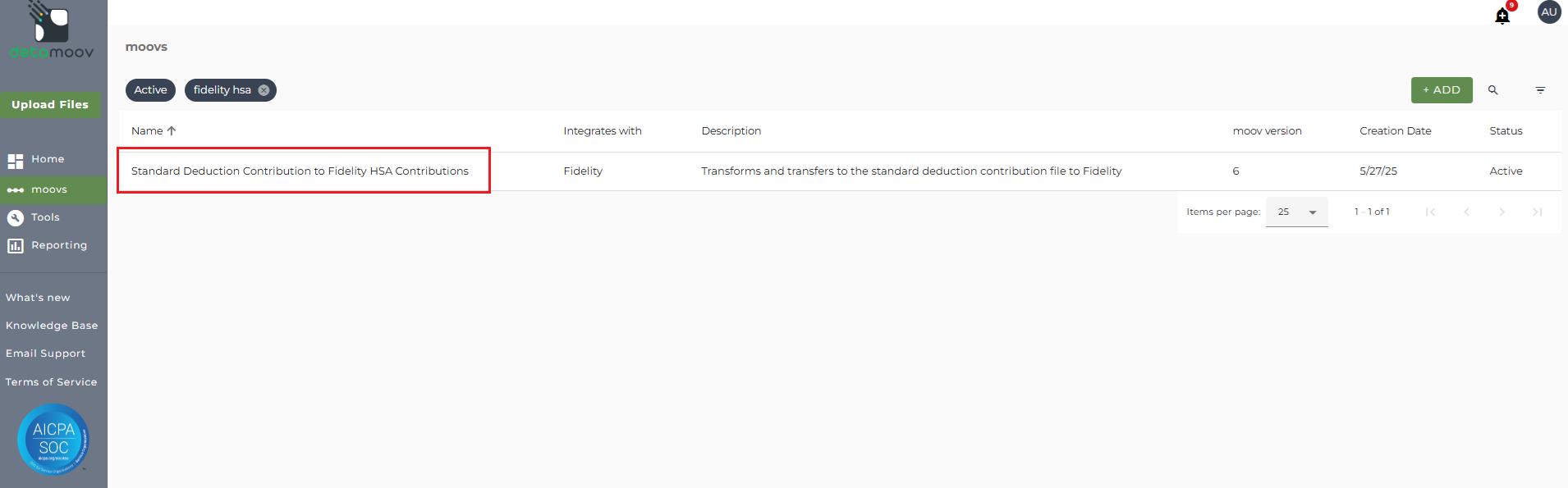

Once the Standard Deduction Contribution to Fidelity HSA Contributions moov has been added to your account, access the moovs section on the left side menu and click on the Standard Deduction Contribution to Fidelity HSA Contributions moov.

Fidelity HSA File Contribution Specifications

For more information on the Fidelity HSA file specifications detamoov uses to transform the Standard Deduction Contributions extract file, please visit the Standard Deduction Contributions to Fidelity HSA Contributions help page.

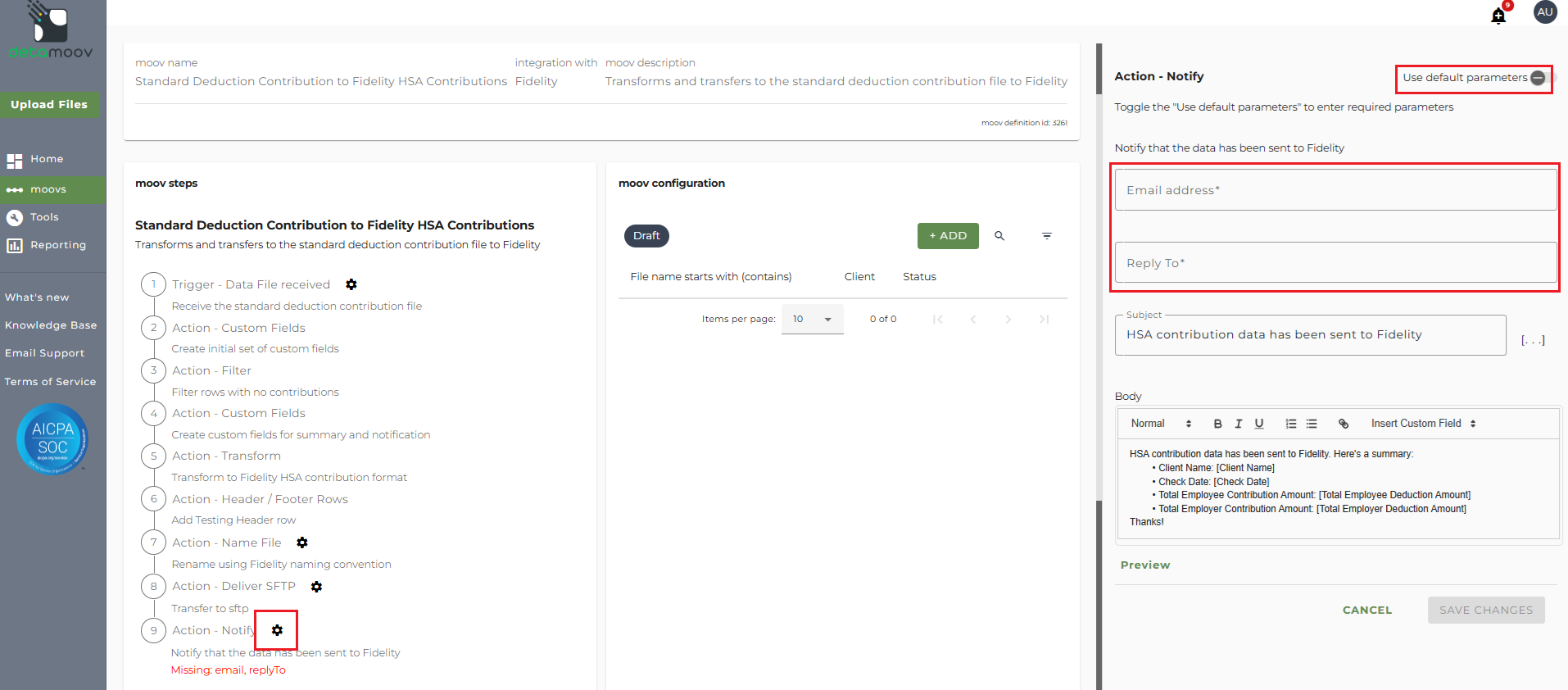

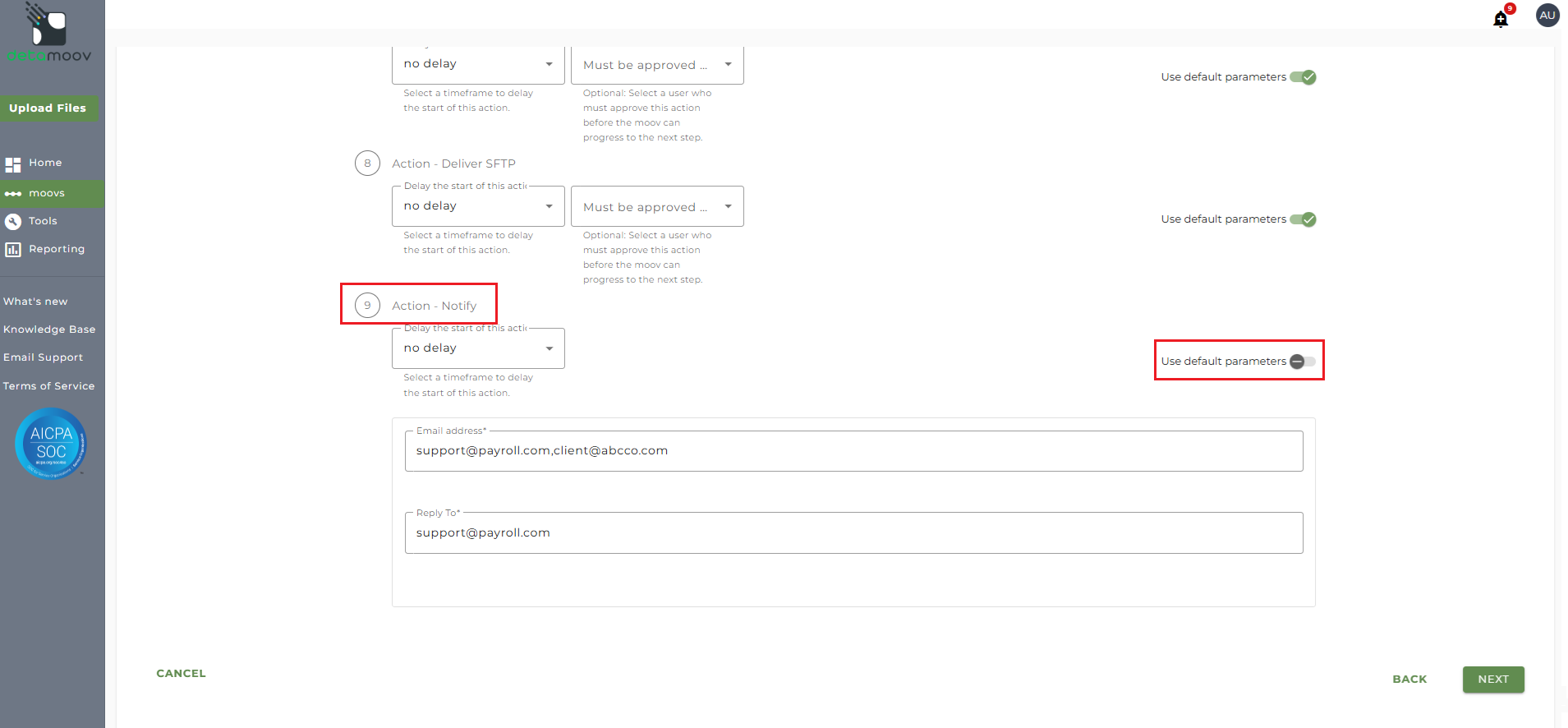

The Standard Deduction Contribution to Fidelity HSA Contributions moov provides a notification for when the moov is complete. The notification can be sent to any email address you wish and can also be configured to send to multiple email addresses.

To edit the notification step, click on the cog icon under the Action - Notify step on the left. Then toggle the "Use default parameters" off and enter in the email addresses you would like to receive the notification. If you would like to enter multiple email addresses, separate them with a comma. A Reply to email is also required in the event that a recipient of the notification replies to the email.

Note: these settings apply to any client configuration you set up for this specific moov. You also have the ability to configure the notification step for each client configuration if you wish to add or remove email addresses per client.

To save your parameters click on the Save Changes button.

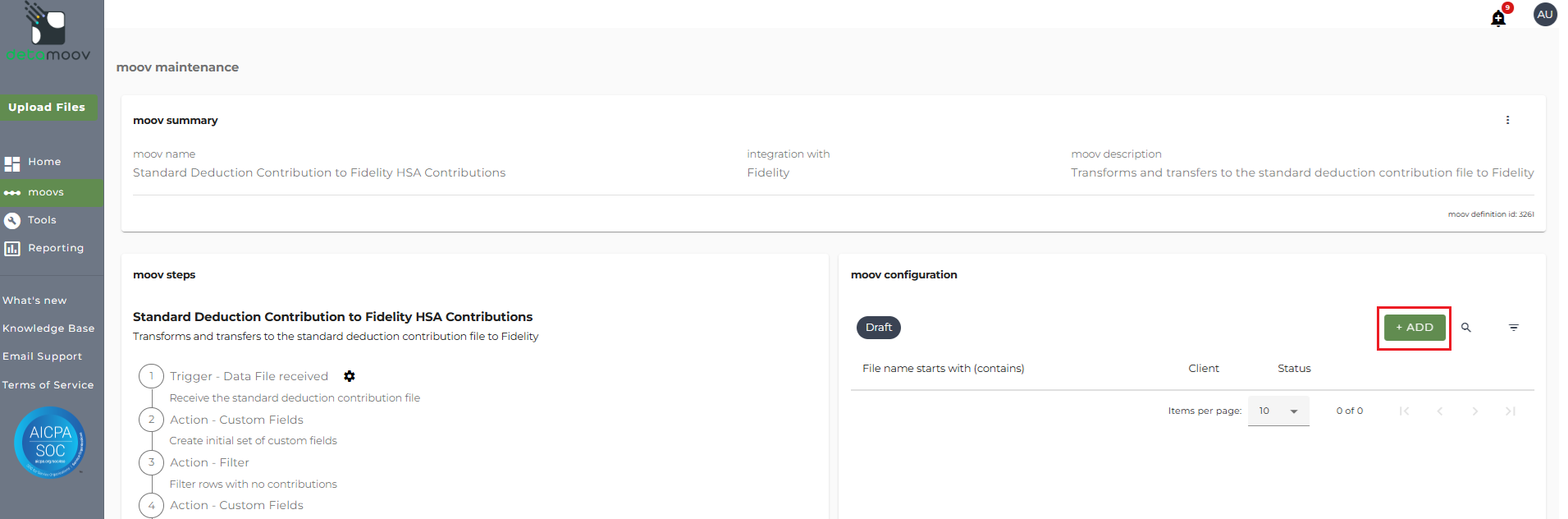

In the moov configuration section, click the Add button to add a new client to send HSA contributions to Fidelity.

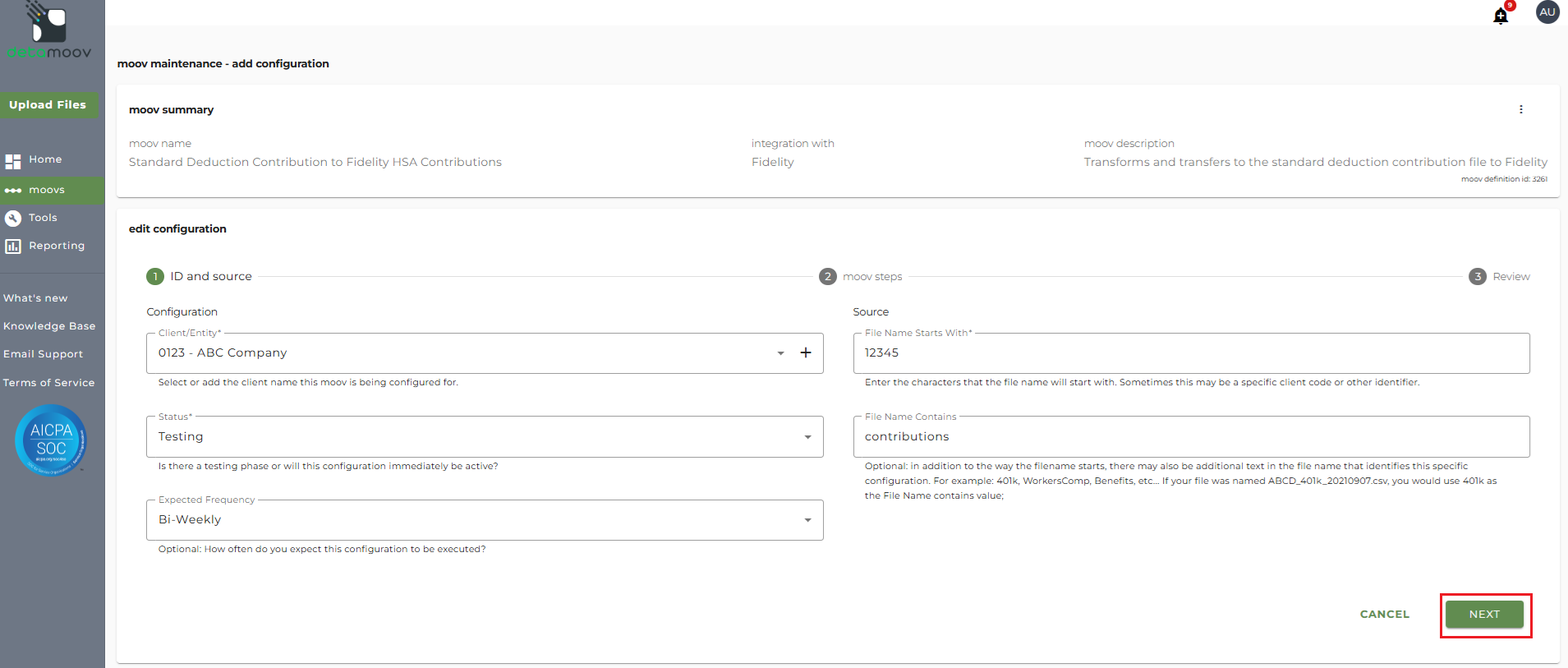

Client/Entity - either select an existing client or click the + sign to create a new client.

Status - the status field is important when configuring a new integration with Fidelity as it provides the correct file name and SFTP director used to send to Fidelity while in their testing phase. This field should be set to 'Testing' until the testing phase has been completed.

Expected Frequency - the client's payroll frequency

File Name Starts With - typically the client or company code within your payroll platform. The value entered into this field is important as the file you send to detamoov must start with this value.

File Name Contains - optional value that is included in the file name

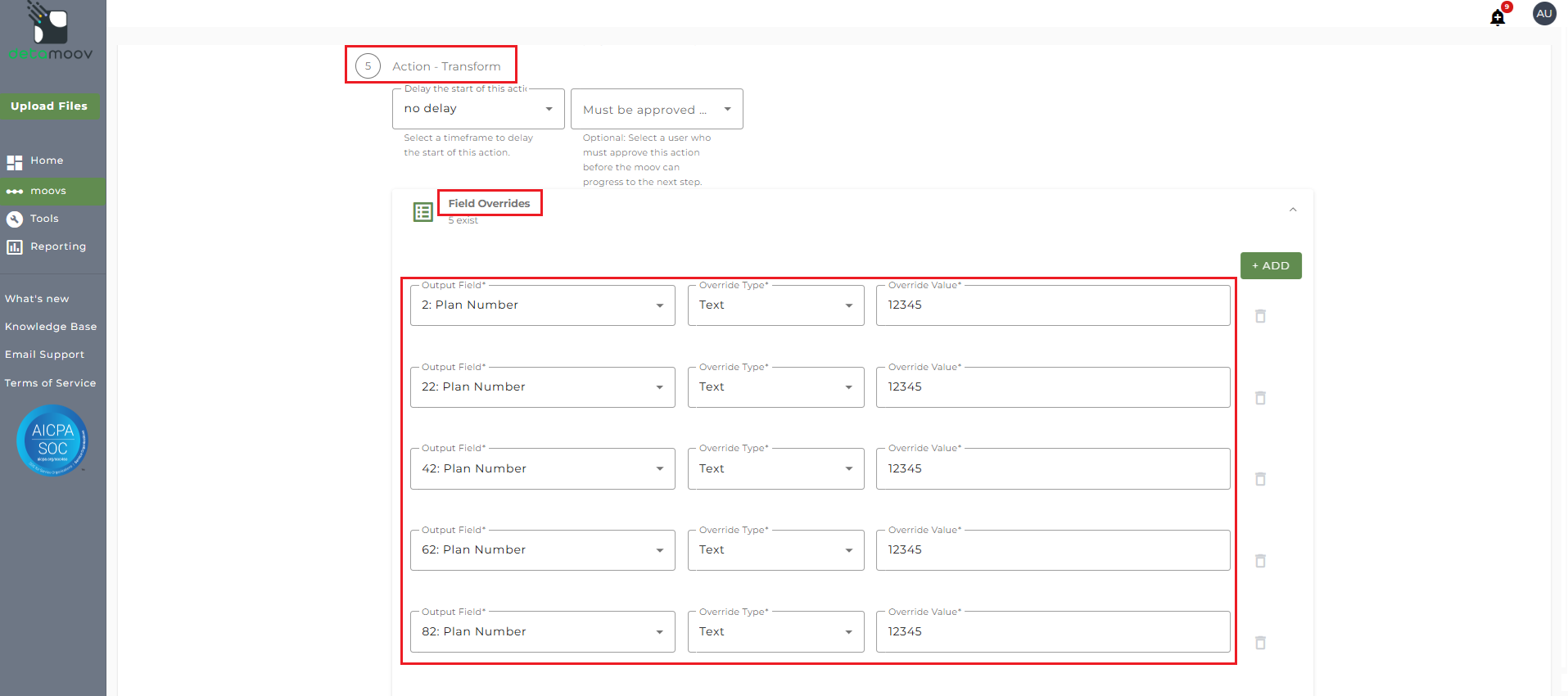

Fidelity requires the Fidelity Plan Number be provided in the contribution file sent to them. If you do not store the plan number in payroll, a field override is required for the the following fields:

2: Plan Number

22: Plan Number

42: Plan Number

62: Plan Number

82: Plan Number

To provide a field override, locate the Action - Transform step, expand the Field Overrides panel, and click ADD. Then create a field override for the fields above.

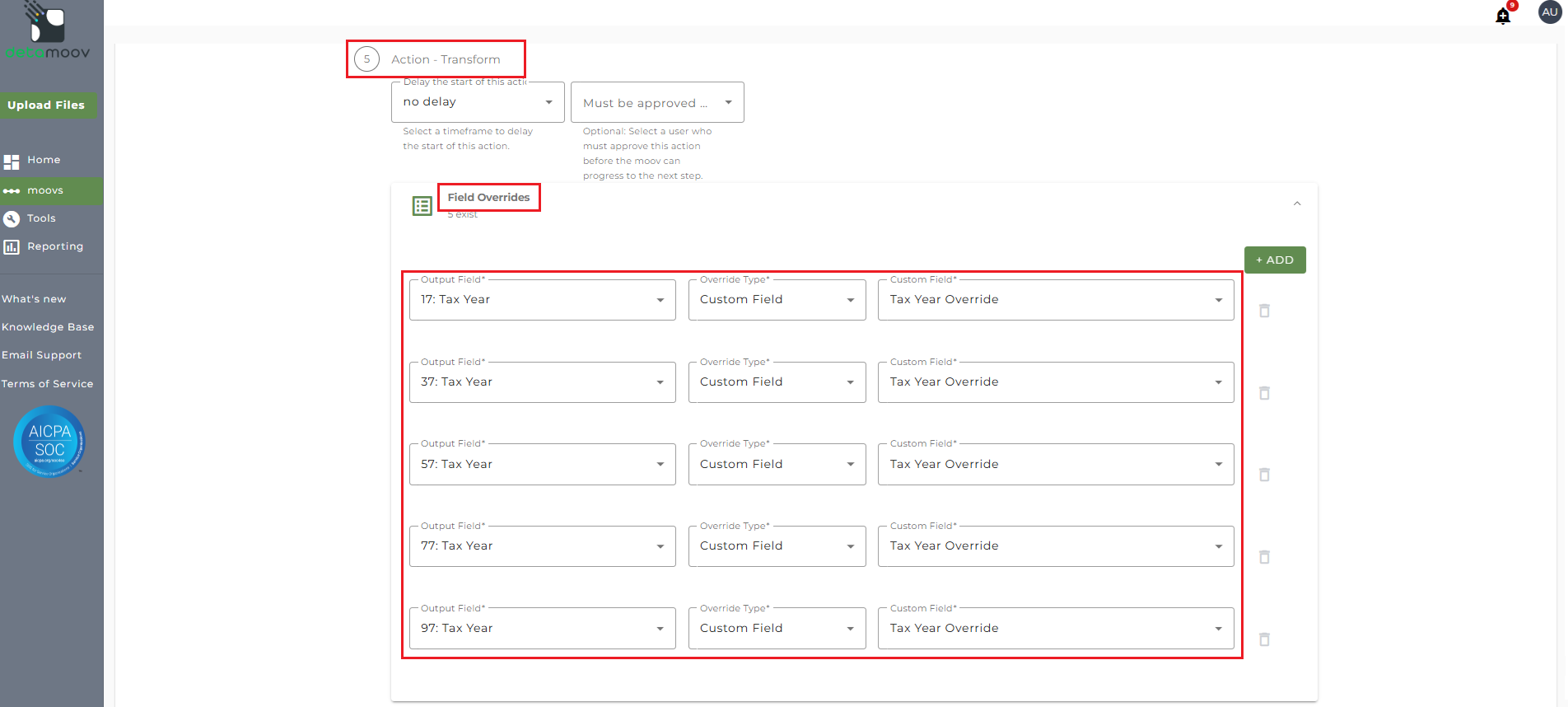

If you are a UKG Ready user and an employee was not paid in the current pay period, field overrides are needed to provide the Check Date and Tax Year fields. detamoov has provided custom fields that take the existing dates from the source file and allow you to apply them to the missing fields.

Tax Year

The following Tax Year fields need a field override:

17: Tax Year

37: Tax Year

57: Tax Year

77: Tax Year

97: Tax Year

To provide the override custom fields, locate the Action - Transform step, click the Field Overrides panel, and click the Add button. Then select the appropriate field from the Output Field dropdown, change the Override Type to Custom Field, and then select the Custom field from the dropdown menu as shown below:

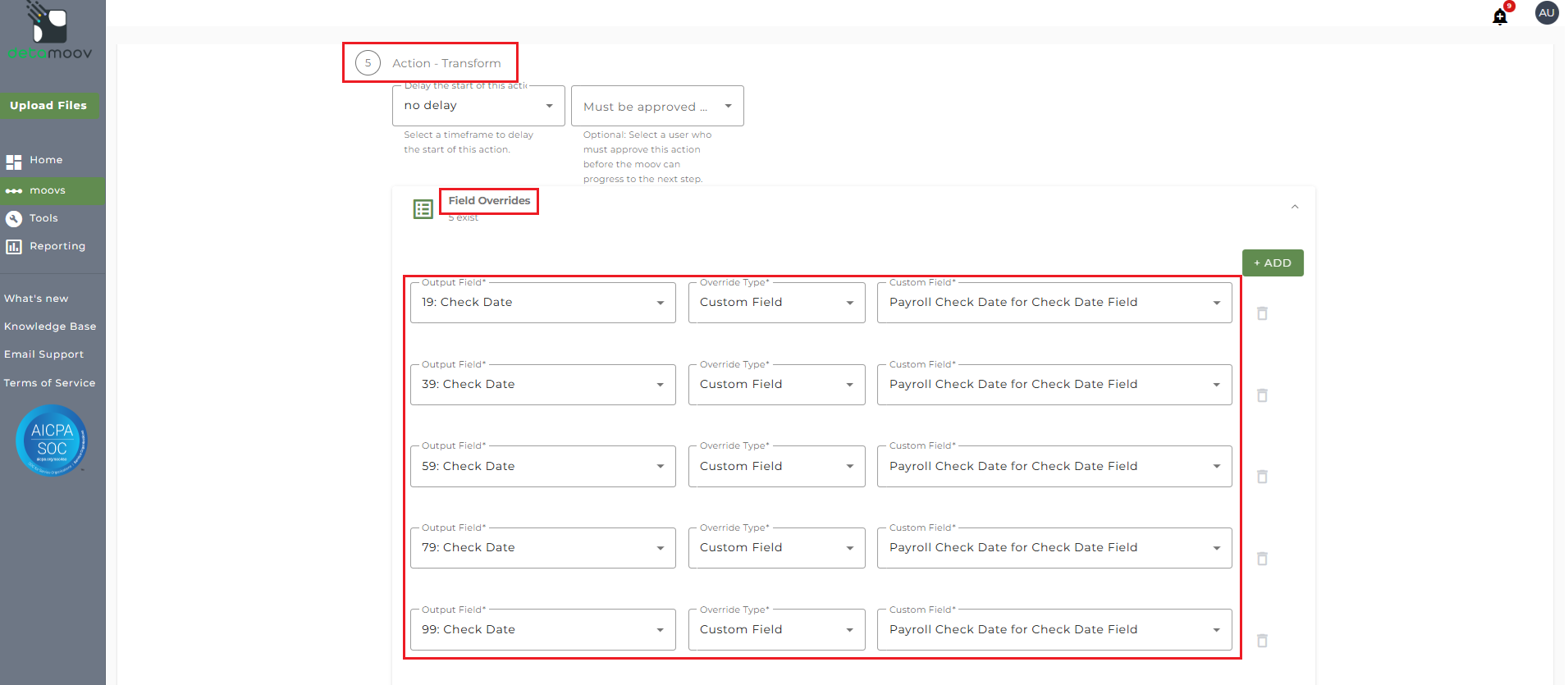

Check Date

The following Check Date fields need a field override:

19: Check Date

39: Check Date

59: Check Date

79: Check Date

99: Check Date

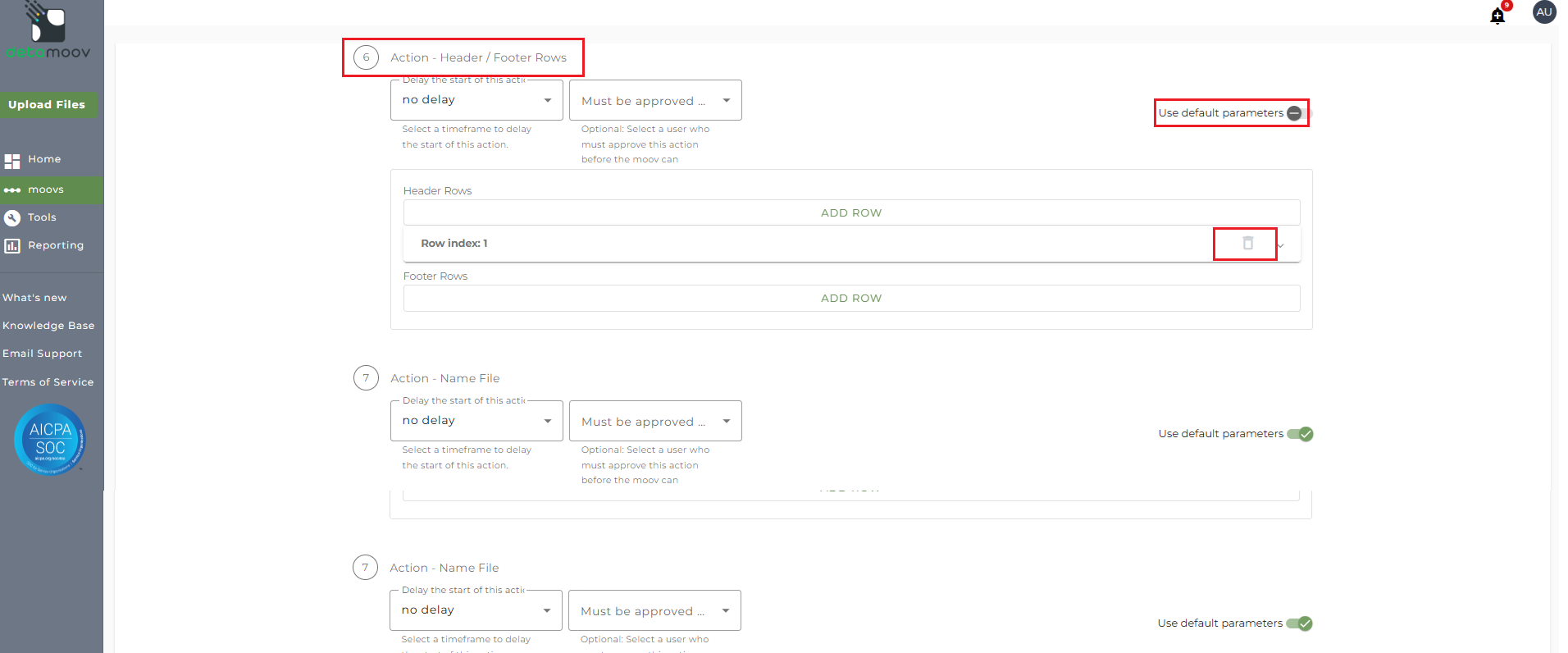

While you are in the testing phase with Fidelity, the header record is sent to indicate a test file. Once Fidelity moves you into production, you will need to delete the test header row.

Note: only delete the test header row once Fidelity approves you for production files.

To delete the test header row, locate the Action - Header/Footer Rows step, toggle the 'use default parameters' OFF, and click on the trashcan icon for Row index: 1.

At the beginning of this article you configured the notification step for the moov to send a notification once the moov had completed. You also have the ability to configure the notification step for each client configuration if you wish to add or remove email addresses per client.

To override the notification step, locate the Action - Notify step and toggle the "Use default parameters" off and enter/remove email addresses from Email Address and Reply To fields. If you would like to enter multiple email addresses, separate them with a comma.

To complete the configuration for your client, click the Next button at the bottom of the page and then the Save button on the moov summary page.