This article describes how to configure a client for the Fidelity Deduction Feedback to PrismHR moov definition used for 360 integration. Each client configuration will vary based on their plan specification and will need to be configured accordingly.

PrismHR - Configure a Web Service/API User

Before detamoov can update deductions in PrismHR, the Allowed Methods for Retirement Providers to PrismHR Integrations (known as "360") must be added to the Web Service/API User. These methods can be found in the Configuring a Web Service/API User in PrismHR article.

Create an SFTP Account in detamoov

Fidelity will send the feedback file to detamoov via SFTP. To create an SFTP account, make sure you are logged in with an administrator level account. Click on your initials in the top right corner and select the Admin Console link.

Within the Admin Console, select the Settings tab and click on the SFTP row. Once the SFTP area expands, click the Add button to add a new SFTP account.

The side sheet will be where you'll enter information on your new SFTP account. All fields are required. Here's some information on each field:

- Username: required, cannot contain spaces and must be unique across all SFTP accounts.

- Password: required and must adhere to the standard detamoov password requirements.

- Confirmation password: required and must match the password field exactly (case sensitive).

- Description: required and used to describe why you're creating this account.

Once you've entered all the information above, click Save and your account will be created.

Provide Fidelity with the SFTP credentials created above to allow them to send the feedback files for your client.

Host: sftp.prod.detamoov.com

Port: 22

Username: username created above

Password: password created above

Fidelity - Electronic Data Transmission Connectivity Form

You will need to complete the Fidelity Electronic Data Transmission (EDT) connectivity form to enable 360. For more information, please see the Fidelity - Electronic Data Transmission Connectivity Form article.

After the PrismHR Premier Integration has been activated on your account and the SFTP account has been created, please add the Fidelity Deduction Feedback to PrismHR moov to your account by following these steps.

Once the Fidelity Deduction Feedback to PrismHR moov has been added to your account, access the moovs section on the left side menu and click on the Fidelity Deduction Feedback to PrismHR moov.

The Fidelity Deduction Feedback to PrismHR moov provides a notification once the moov is complete with a summary of the retirement plan and loan changes that were made in PrismHR. The notification can be sent to any email address you wish and can also be configured to send to multiple email addresses.

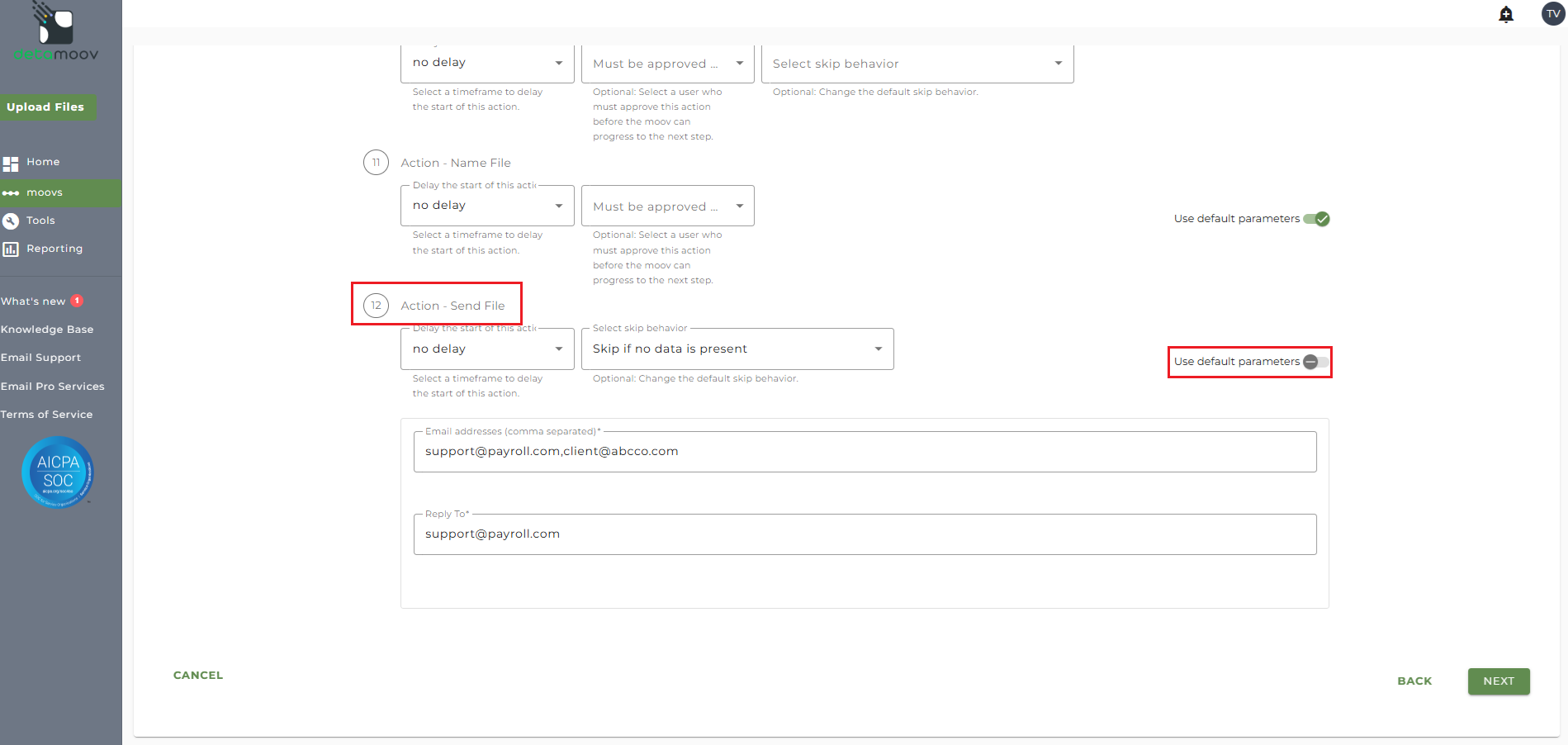

To edit the send file step, click on the cog icon under the Action - Send File step on the left. Then toggle the "Use default parameters" off and enter in the email addresses you would like to receive the notification. If you would like to enter multiple email addresses, separate them with a comma. A Reply to email is also required in the event that a recipient of the notification replies to the email.

Note: these settings apply to any client configuration you set up for this specific moov. You also have the ability to configure the send file step for each client configuration if you wish to add or remove email addresses per client.

To save your parameters click on the Save Changes button.

In the moov configuration section, click the Add button to add a new client to the moov.

Client/Entity - either select an existing client or click the + sign to create a new client.

Status - Set to Active

Expected Frequency - the client's payroll frequency

File Name Starts With - odc[Fidelity provided value]

File Name Contains - def

Note: make sure that the File Name Starts with and File Name Contains fields match as this can cause issues pulling the Fidelity feedback file and updating PrismHR.

Click Next once you have completed the ID and source section.

Fidelity Deduction Feedback File Format

The Fidelity Deduction Feedback file is sent in a fixed-length format where each deduction is identified by a Record Identifier. Below is a table showing the Fidelity Record Identifiers and the corresponding deduction type:

| Record Identifier | Deduction Type | Notes |

| 01 | Participant Identification | |

| 02 | PreTax/AfterTax Percent | Supported |

| 02R | Roth Percent | Supported |

| 04 | PreTax/AfterTax Dollar Amount | Supported |

| 04R | Roth Dollar Amount | Supported |

| 05 | Status Code | |

| 06 | Spillover Percent | Not supported in detamoov |

| 06C | Catch Up Percent | Supported |

| 06R | Roth Catch Up Percent | Supported |

| 07 | Spillover | Not supported in detamoov |

| 07C | Catch Up Dollar Amount | Supported |

| 07R | Roth Catch Up Dollar Amount | Supported |

| TT1 | Trailer Record |

Certain records are automatically sent for a participant when your client's plan has an available election, even if the participant has not made an election. For example:

If Roth elections are available in the plan, the Pre-Tax/After-Tax records and Roth records will always be sent together.

If Roth Catch Up elections are available in the plan, the regular Catch Up records and Roth Catch Up records will always be sent together.

Also, Fidelity sends a changes-only file which means that if a participant changes one or more of their deferral elections, all of their deferral elections will be fed back on the feedback file.

The Pre-Tax and After-Tax deductions exist on the same record in the Fidelity Deduction Feedback file. detamoov needs to create both of these deductions from the record as we have no way of knowing if your client's plan has one or the other, or both. So we create a filter to remove the After-Tax record by default and allow you to override the default settings.

Remove the After-Tax filter

If your client's plan has an After-Tax contribution then you will need to remove the default filter rule to allow detamoov to send the appropriate deduction.

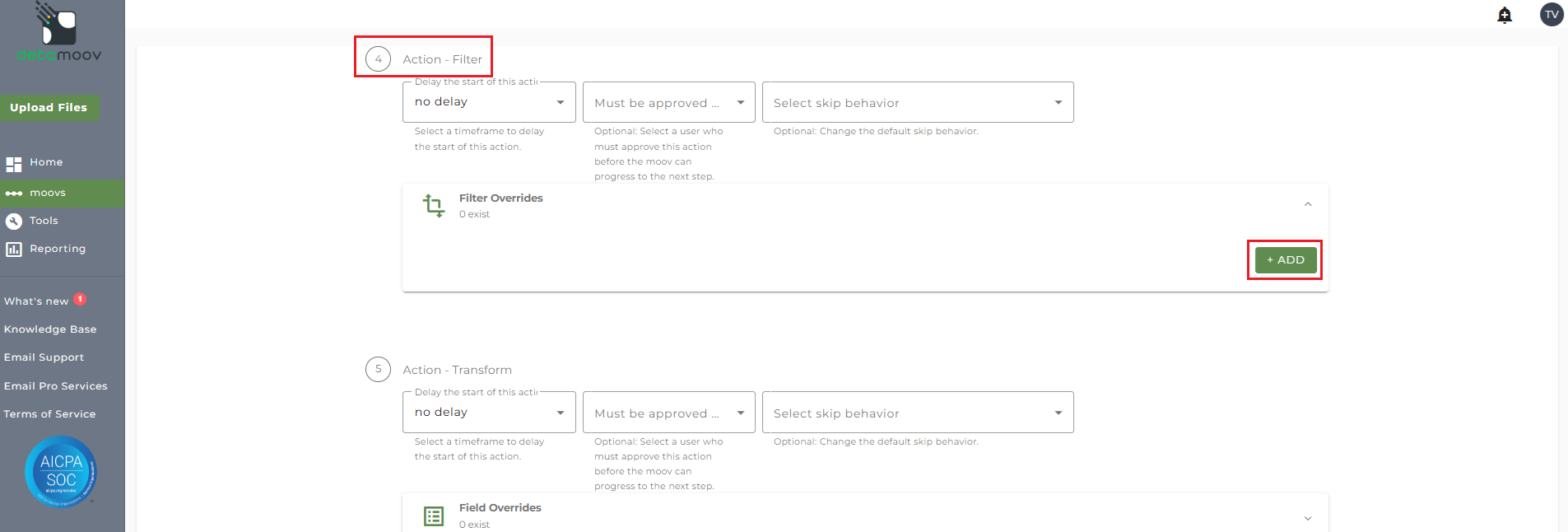

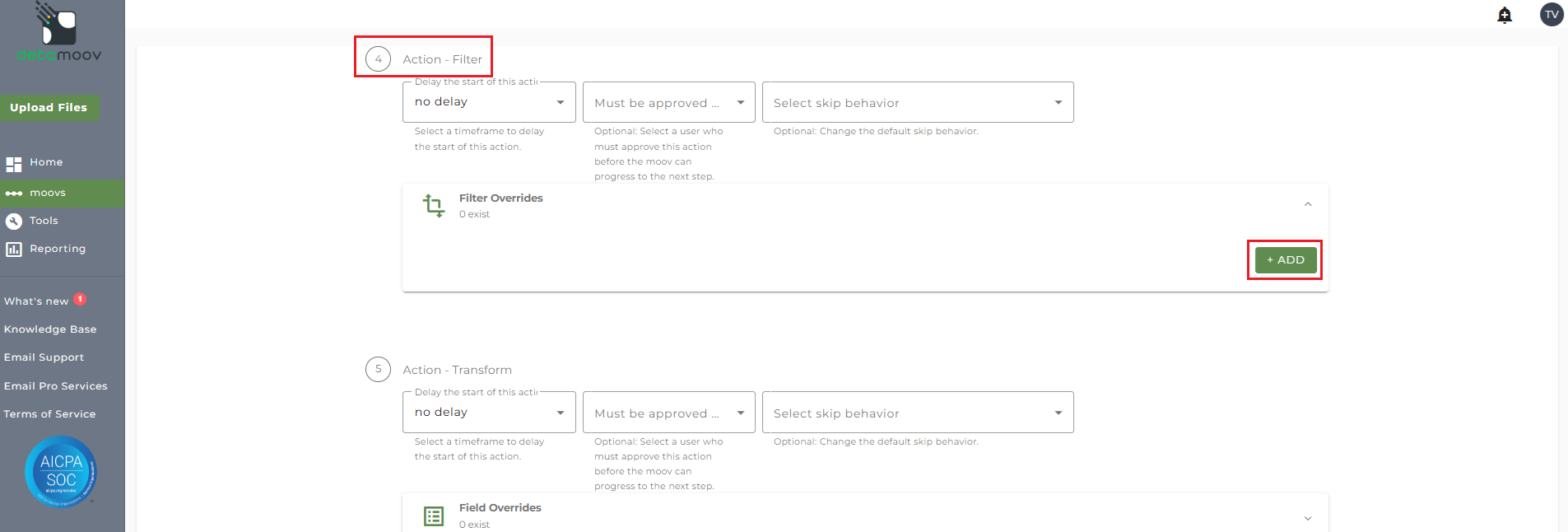

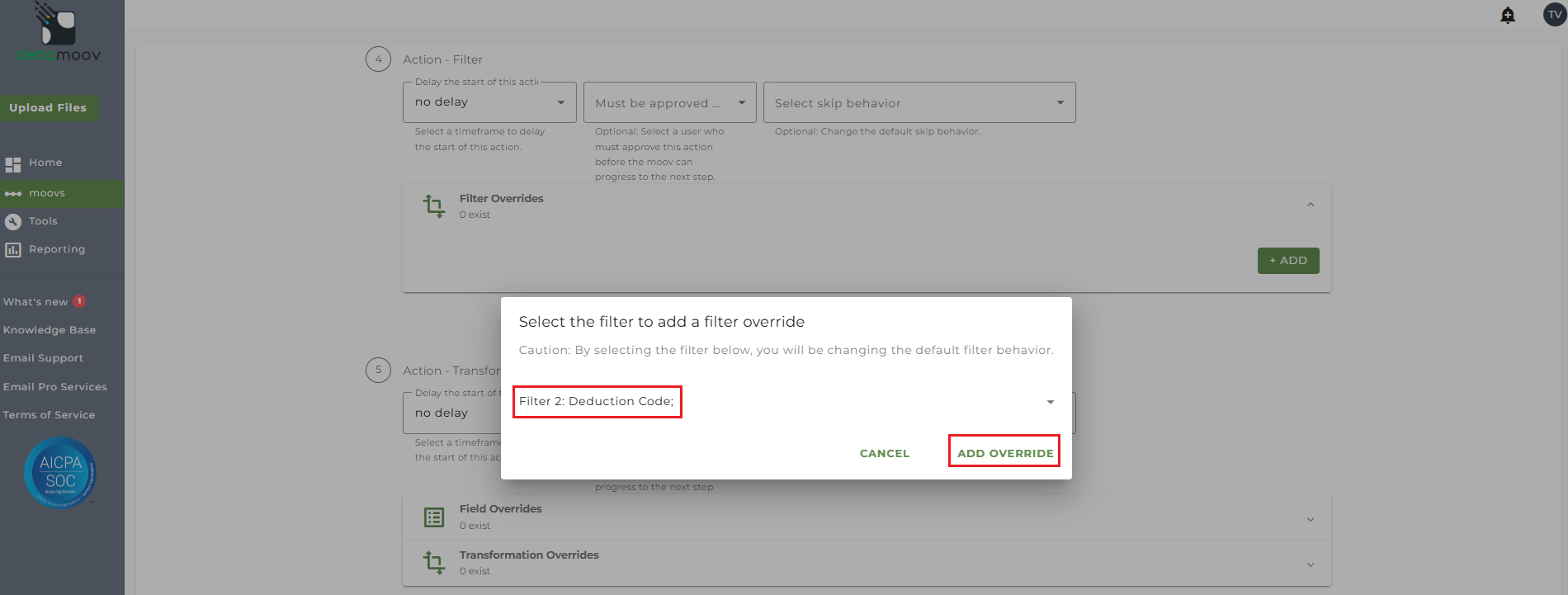

To create a filter override locate the Action - Filter step, expand the Filter Overrides section and click ADD.

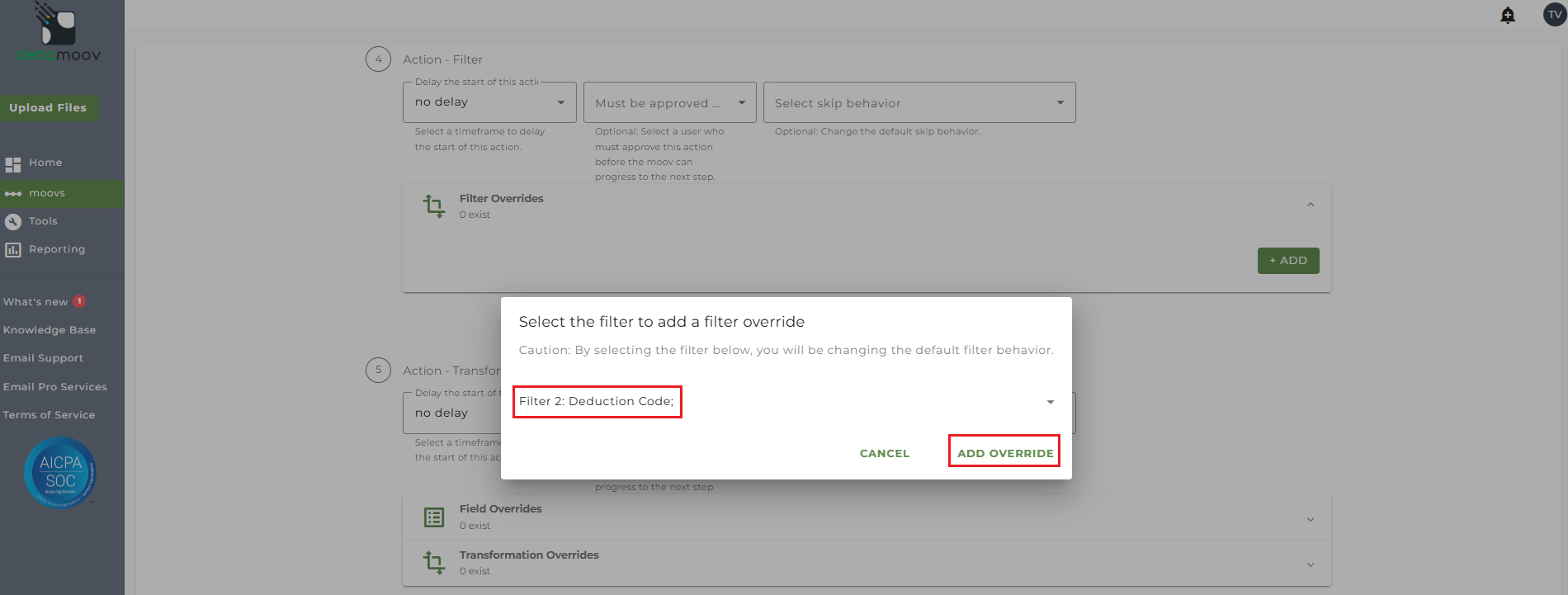

Next, select Filter 2: Deduction Code and click Add Override.

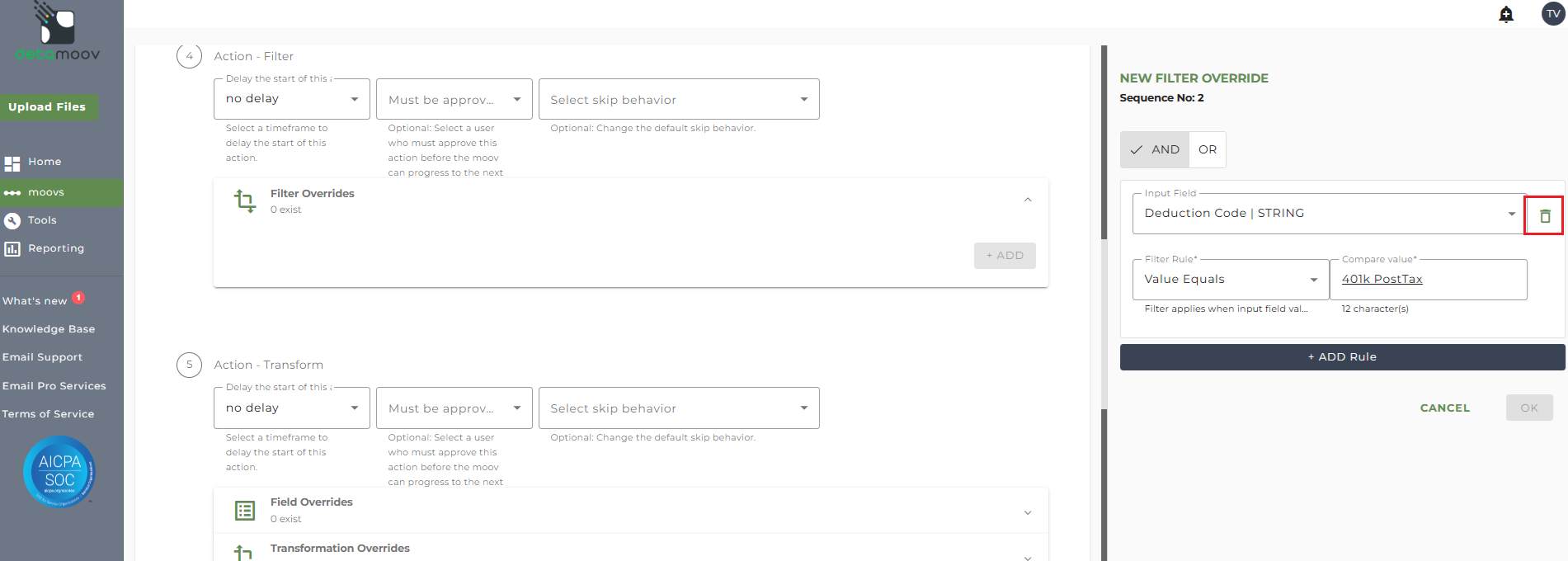

Then on the right-hand side, hover over the Deduction Code | STRING field and click the trash can icon and click OK.

Add a Pre-Tax filter

If your client's plan has an After-Tax contribution, but doesn't have a Pre-Tax contribution, then you will need to change the default filter rule to allow detamoov to send the appropriate deduction.

To create a filter override locate the Action - Filter step, expand the Filter Overrides section and click ADD.

Next, select Filter 2: Deduction Code and click Add Override.

Then on the right-hand side, replace the text "401k PostTax" with the text "401k" and click OK.

The PrismHR Plan ID is required for detamoov to update changes via their API. A field override is required to provide this as the Plan ID in Fidelity may be different from the Plan ID in PrismHR.

The PrismHR Plan ID can be found in Benefit Plan Maintenance/Retirement Plans:

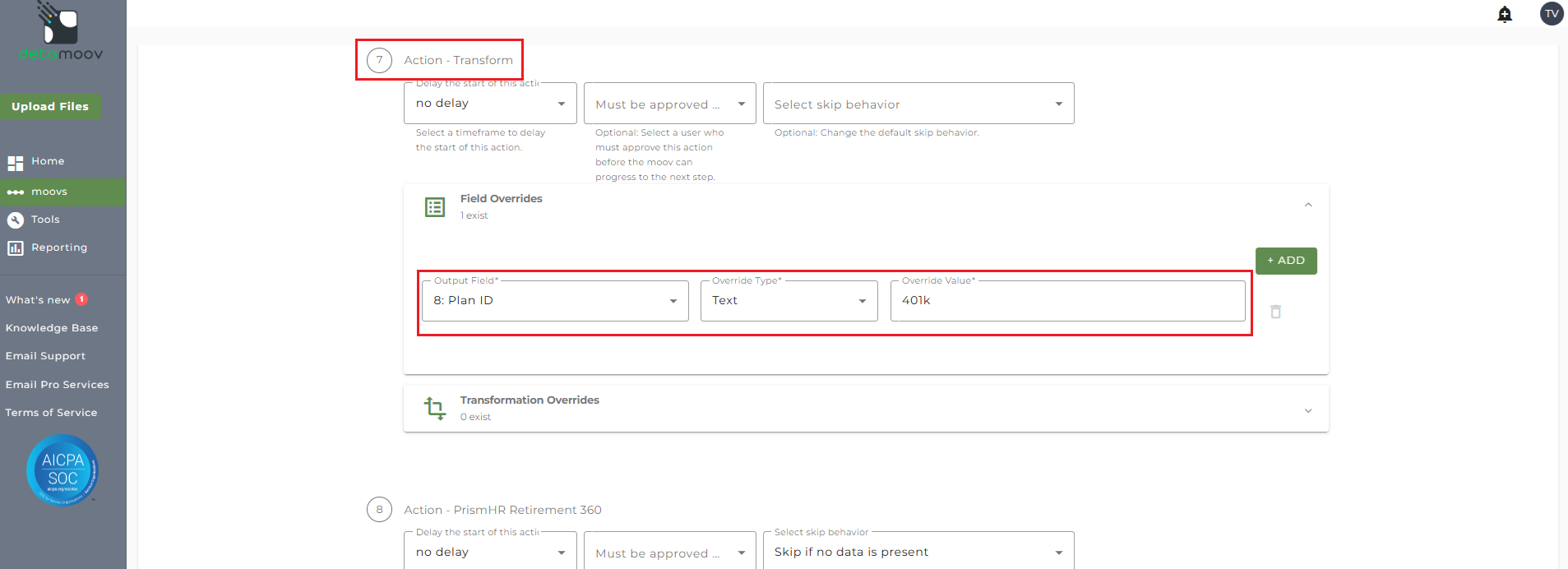

To create a field override locate step 7 Action Transform and expand the Field Overrides section.

NOTE: There are 4 separate Transform steps on the Fidelity Deduction Feedback to PrismHR moov. Make sure are you creating the field override on step 7 - Action Transform.

Then click the ADD button and select field 8: Plan ID and enter you the PrismHR Plan ID in the Override value field.

Configure the PrismHR Retirement 360 Step

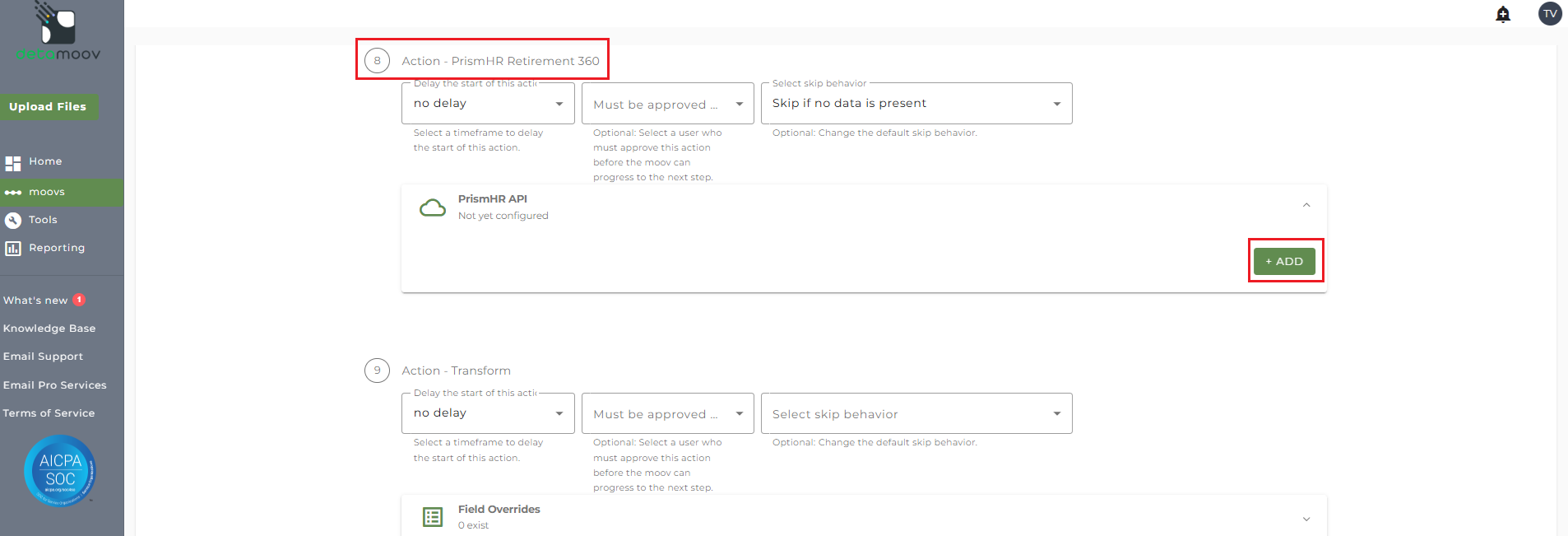

To configure the PrismHR Retirement 360 step for you client, locate the Action - PrismHR Retirement 360 step, expand the PrismHR API panel and click ADD.

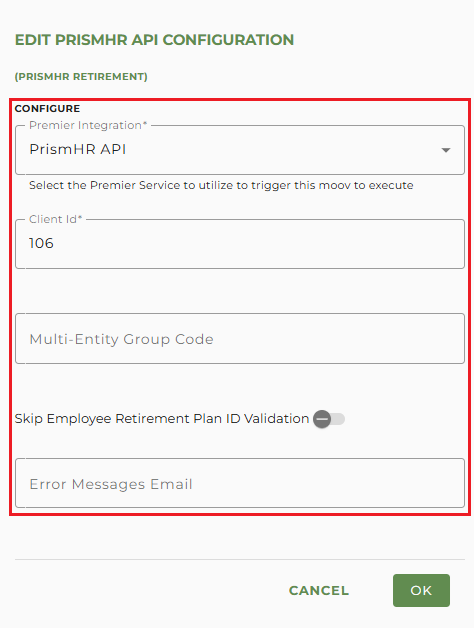

On the side panel that appears, select your PrismHR Premier Integration and enter in the Client Id.

If you have a Multi-Entity Group set up for your clients, please see the Using Multi-Entity Groups article for information on how to use a Multi-Entity Group on your configuration.

Optionally, you can toggle the 'Skip Employee Retirement Plan ID Validation' switch on. This is applicable when your client has multiple retirement plans inside PrismHR and you don't want detamoov to validate the Plan ID field for each employee. If this option is toggled on, detamoov will skip the validation of the employee retirement plan ID when updating existing deferrals and loans. Since most situations require retirement plan ID validation, this option is toggled off by default.

You can also enter in one or more email addresses in the Error Messages Email. If left blank, all detamoov users on your account will receive emails if the PrismHR Retirement 360 step fails.

Click OK to complete the PrismHR Retirement 360 configuration.

At the beginning of this article you configured the send file step for the moov to send a notification once the moov had completed. You also have the ability to configure the send file step for each client configuration if you wish to add or remove email addresses per client.

To override the send file step, locate the Action - Send File step and toggle the "Use default parameters" off and enter/remove email addresses from Email Address and Reply To fields. If you would like to enter multiple email addresses, separate them with a comma.

To complete the configuration for your client, click the Next button at the bottom of the page and then the Save button on the moov summary page.

Fidelity sends the updates to loans in a separate file and requires that you configure the Fidelity Loans Feedback to PrismHR moov. If your client's plan has loans, please see the Fidelity Loan Feedback To PrismHR moov article.